Total Till sales at UK supermarkets grew solidly in the last four weeks, according to new data released today by NIQ.

The 5.4% growth over the four weeks to 23 March 2024 was a slight increase compared to 5.3% increase reported in February, with a drop in food inflation (3.7%) compared to 15% a year ago, encouraging shoppers to buy more. Shoppers also spent more (£20.10) in the last four weeks compared to £19.50 this time last year.

While visits to stores increased by 1.1%, there was a slowdown in the growth of online (+3.1%), with its share of FMCG spend dipping to 10.9% (compared to 11% a year ago).

The NIQ data also reveals that shoppers took advantage of Mother’s Day discounts to celebrate, as the event saw supermarket sales grow 11.9% during the week ending 9 March. Dining in was a popular option for many shoppers, with an uplift in sales for produce (+8.5%) and meat, fish & poultry (+8.4%). During this period, the Sunday Roast also became a focal point for retailer promotions with 27% of own label meat, fish & poultry purchased on promotion during the month.

With lower food inflation, packaged grocery (+3.5%), frozen (+3.1%), delicatessen (+3.0%), beers, wine and spirits (+2.7%), bakery (+2.4%) and dairy (+1.8%) all saw below-inflation value growth. However, with shoppers still reigning in spending, they spent less on household (-0.5%) and pet & petcare (-3.7%) items over the four-week period.

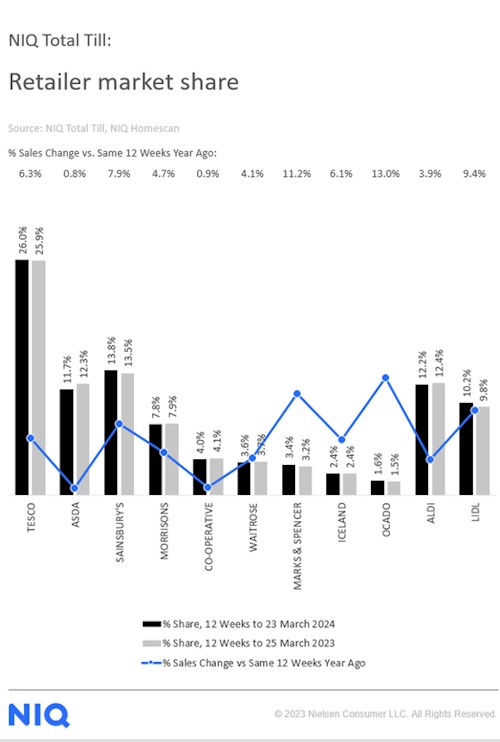

In terms of retailer performance over the last 12 weeks, Sainsbury’s (+7.9%) and Tesco (+6.3%) were the fastest-growing main supermarkets, with M&S (+11.2%) and Ocado (+13%) also growing market share. Morrisons saw an increase (+4.7%) in sales, whilst Asda recorded the slowest growth (+0.8%).

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “As inflation slows, we have seen an improvement in grocery sales volumes during Q1. A driver of this was the further fall in food prices in March, together with intense competition amongst the supermarkets looking to drive footfall with promotional offers as seen on Mother’s Day and in the weeks leading up to Easter. However, overall consumer spend remains under pressure as many household bills continue to increase above CPI and this is reflected in the continued weak consumer confidence.”

Watkins added: “Encouraging more visits is likely to be the next battleground for retailers now that we have lower inflation. The wet and cold weather in the first quarter of the year may have deterred some store visits, but we saw that the early Easter offered some attractive seasonal promotions which encouraged shoppers to buy more. When drier, warmer spring weather eventually arrives this will continue to support volume growths across all channels.”

NAM Implications:

- Some green shoots…

- …but some shoppers still holding back.

- And Asda stands out for having the slowest growth despite all its activity…

- Supplier initiatives that encourage more store visits appear to be an opportunity…