Retail sales volumes in the UK rose by an unexpected 0.5% in September, driven by consumers buying gold online and new tech gadgets.

The fourth consecutive monthly increase was far better than the 0.2% decline predicted by economists amid stubborn inflation and ahead of what is expected to be a tough Budget next month.

Non-food stores (the total of department, clothing, household, and other non-food stores) rose by 0.9%, with tech retailers benefiting from the launch of Nintendo’s long-awaited Switch 2 gaming console and Apple’s iPhone 17. Within non-store retailing (+1.5%), online jewellers reported strong demand for gold.

Meanwhile, with consumers squeezed by higher supermarket prices, food sales volumes edged down 0.1%.

Analysts noted that figures were positive, but concerns remain that the British economy is slowing.

Danni Hewson, AJ Bell head of financial analysis, said consumers were starting to feel a bit more confident about spending. “Interest rate cuts and above-inflation pay increases have meant many workers have had a bit more cash to play with, even if pressures on household budgets have remained high.”

Alex Kerr, UK economist at Capital Economics, stated that the month-on-month rise in retail sales volumes was better than expected. “But against a backdrop of weak employment, high inflation and with tax rises on the horizon, we doubt the retail sector will be able to sustain this strength,” he said.

Meanwhile, Nicholas Found, Head of Commercial Content at Retail Economics, commented: “Affordable luxuries in beauty and new tech launches in electricals are standing out, but the broader picture is one of households tightening their belts. Shoppers are taking a cautious, deliberate approach to spending, as budgets remain under pressure from essential living expenses.

“The late Autumn Budget next month couldn’t come at worse time for the sector, landing just as retailers gear up for peak trading over Christmas. Growing concerns around tax and borrowing costs are weighing on consumers’ spending intentions, prompting fiercer competition for limited discretionary spend.”

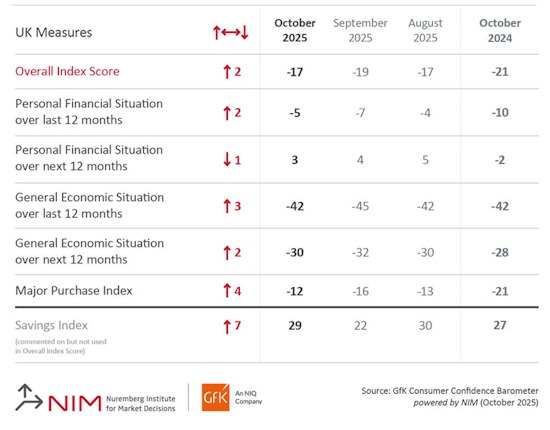

Separate figures released by GfK today showed that consumer confidence increased two points to -17 in October, equalling the highest level recorded this year. Four measures were up and one was down in comparison to last month’s announcement.

Neil Bellamy, consumer insights director at GfK, noted the rise in the main index reflected a four-point increase in the ‘major purchase index’ component as consumers took advantage of the Amazon Prime sale earlier this month and looked ahead to Black Friday on 28th November.

Neil Bellamy, consumer insights director at GfK, noted the rise in the main index reflected a four-point increase in the ‘major purchase index’ component as consumers took advantage of the Amazon Prime sale earlier this month and looked ahead to Black Friday on 28th November.

“This uptick is partly driven by major retailer sales events held earlier in the month. After several years of high inflation, savvy consumers have adapted their purchasing strategies to make the most of their money,” he said, adding that many people now delay major purchases until retailer promotional periods.

Meanwhile, households’ assessment of the general economic situation and their own personal situation over the past 12 months improved, as did their outlook for the general economy over the year to come. But their view of the outlook for their own finances over the coming year worsened.

Bellamy concluded: “Both consumers and UK retailers will be watching closely to see whether the Chancellor’s Budget, to be announced just two days before Black Friday, boosts or dampens spending during that crucial weekend.”

NAM Implications:

- Difficult to know whether the ‘unexpected upturn’ or a continuing fall in retail sales has a worse impact on levels of consumer uncertainty.

- The key is to rely on actual volume sales in your category.

- And ensure you cover the basics of on-shelf availability.

- The rest is detail…