Deloitte has released its annual Global Powers of Retailing 2023 report, listing the 250 largest retailers around the world based on publicly available financial data and analysing their performance across geographies and product sectors. It also looks at the fastest growers and latest trends, and provides an economic outlook for 2023.

The report shows that the top 250 retailers achieved a total composite retail growth rate of 8.5% over the fiscal years ended between 1 July 2021 to 30 June 2022. The top 10 retailers grew by 8% on a composite sales-weighted and currency-adjusted basis.

The study highlights that the leading digital retailers benefitted from pandemic-related behavioural shifts, with attracting customers back to bricks & mortar stores now an area of intense investment.

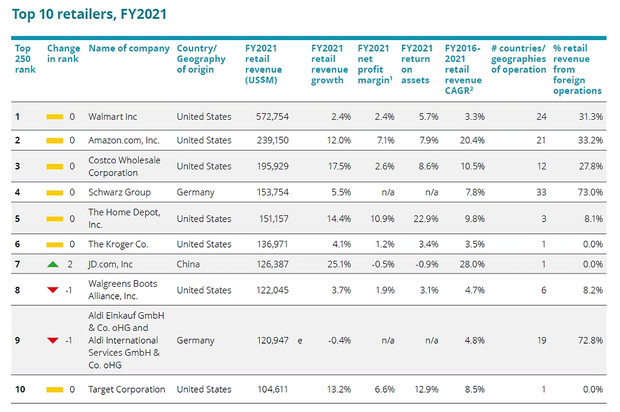

Whilst Amazon benefited from shifts towards online shopping, JD.com was the fastest-growing top 10 retailer, with revenues up by 25.1%. The majority of the top 10 retailers boosted their digital capabilities via in-store technologies or through enhancing omnichannel offerings.

The report also shows that sustainability efforts have shifted into new focus areas. Evan Sheehan, Deloitte Global Retail, Wholesale & Distribution Leader, commented: “In a year of strong year-on-year growth in retail revenue across the Top 250, sustainability remains high on the agenda. Several players are working on the resale of slightly used goods and we see many technology-enabled innovations.”

Walmart again led the global retailer ranking, and of the retailers in the top 10, 70% are based in the US, compared to 28% of US retailers in the top 250. Additionally, there was a 2.8 percentage point increase in the retail revenue from foreign operations among the Top 10 (27.9%) relative to the previous year.

Meanwhile, the composite net profit margin among the top 10 grew by 0.2 percentage points to 4.1%, but net profit margins among the leaders vary widely, ranging between -0.5% to 10.9%. Target, Walgreens, and Amazon increased their profit margins by more than 1.5 percentage points in the period. The increase in profitability came despite the continuing pressure from the pandemic, inflation of energy and goods, and rising labour costs.

Download the Global Powers of Retailing 2023 report (PDF)

NAM Implications:

- Key to study this 74-page report in detail.

- And use as a benchmark to assess your global sales by retailer.

- Think fair share of sales and investment…

- …whilst factoring in inflationary impact for the following year.

- (If time, think what these top 250 retailers can achieve via Retail Media…)