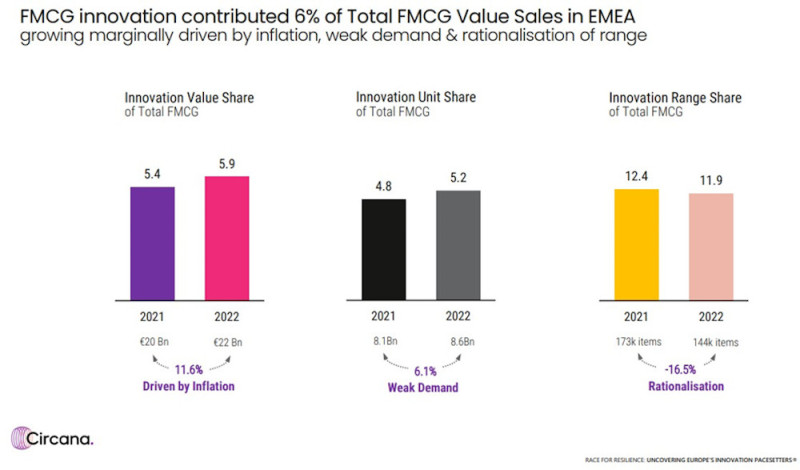

A new report released today shows there has been a decline in product innovation in the FMCG sector over the last two years, particularly across larger brand manufacturers – suggesting a growing aversity to the perceived gamble of new products as sales volumes fall amid the tough trading conditions.

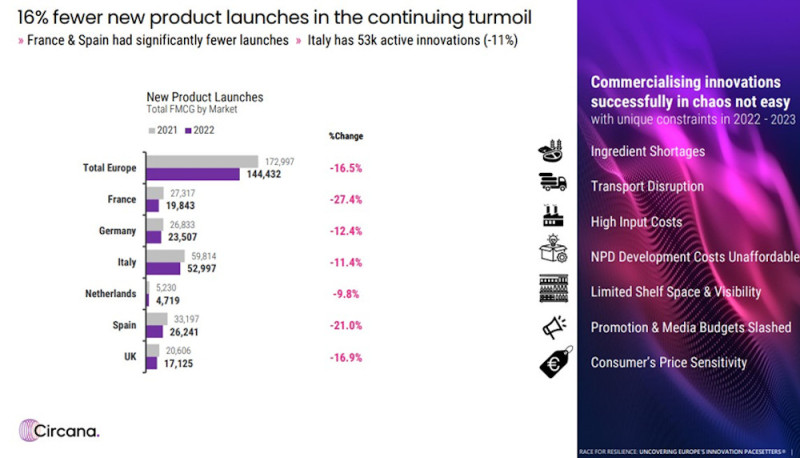

The ‘Race for Resilience: Innovation Pacesetters’ study by Circana covers the six largest markets in Europe (France, Italy, Germany, Spain, UK, and the Netherlands). It found that 144,432 new products were launched across Europe in 2022 compared to 172,997 in 2021 (-16.5%). The largest drop was seen in France, where new product launches fell from 27,317 to 19,843 (-27.4%).

Fewer innovations reflected both manufacturers and retailers prioritising their existing core ranges to maintain availability on shelves to protect volume and share, and perhaps declining confidence in commanding a premium price typically associated with new products as businesses continue to grapple with the inflation crisis.

Small and medium-sized manufacturers, leveraging their ability to react to changing market forces quickly, were responsible for 75% of all new products launched, contributing 68% of total value sales from new products. While just one in four new product launches were brought to market by large brand manufacturers over the period, they delivered greater share value (32% of new product value sales) due to their distribution and supply chain advantages.

Ananda Roy, Global SVP of Strategic Growth Insights at Circana, noted that innovation continues to be a sustainable source of organic growth, despite the difficult trading conditions and the cost of living crisis. “While the ability to command a significant premium is constrained, new product launches continue to deliver the volumes that brand manufacturers need to maintain growth and market share,” she said.

“New product launches can feel like a gamble when there is increasing competition for shelf space, especially at a time when the industry is experiencing declines in sales volumes of FMCG products. However, there is no doubt that it can add immense value too, giving brands the opportunity to expand an existing portfolio or even create an entirely new one. Innovations continue to be resilient and help to drive demand despite inflationary headwinds.”

Key findings from the Circana report include:

- Consumer attitudes & behaviours that determine the success of new product launches have changed – for example, shoppers expect new products to add value (e.g. have new features – 77%, be versatile by combining benefits – 72%), to be sustainable (71% expect it to be better for them and 68% says the same for the environment), to be trusted (65%), and must now fit with their lifestyle (73%) and help them to achieve their goals (67%).

- Shoppers are more likely to try new products that are at a lower price (59%), readily available (50%), easy to shop & use (both 56%), fits the shopper’s routine (46%). Recommendations from family and friends and a large well-known company also play important roles (both at 47%). Celebrity or influencer recommendations or endorsements convince just 9% of shoppers to try new products, despite their ability to attract awareness.

- Satisfied trialists expect physical availability next time they shop – 48% of trialists look for the new product next time they shop and less than 20% ask in-store or go online to buy if it isn’t available. 23% will look for another innovative product like it, usually from another brand. Circana noted that it is important to get the product experience right the first time, as nearly two-thirds of shoppers (64%) would not buy a new product again if it didn’t meet expectations.

- New product launches in the chilled and fresh category delivered the most value despite fewer products being launched. Here manufacturers and producers tapped into healthy eating trends such as plant-based and natural. Value share from innovations in the sector increased and now represents 22% of total FMCG innovation value share, some €4.8bn.

- Innovation drove 6% of total baby food value sales, a growth of 75% over last year as parents sought healthier options that met a variety of taste, ingredient and diet options. New products in this category now represent €12bn in value sales.

- Innovation in pet food rose by 39% as more people took ownership of pets. Led by manufacturers in the UK and Italy, the innovation is about providing pets with healthier treats and food. The value share contributed now 4.3%, an increase of 51%.

- Frozen food saw product value up by 40% on the previous year, driven by consumers choosing frozen instead of chilled and fresh to meet new food planning behaviours and avoid waste.

- Brewers had a reduced thirst for new product launches focusing instead on the growth of segments of low/no alcohol and ready to drink. Alcohol volume sales overall are showing a significant decline. This action resulted in 15% less value share derived from new products.

- Range rationalisation makes it harder for new products to survive, with continued range rationalisation from retailers who want to maximise the return on shelf space by axing slower-selling items, it is harder than ever for new products to survive. Of all of the new products launched in 2021, just 74% remained on shelves in their second year. Although approx. 90% of launches still contribute less than €500k per SKU in their first year of launch, 23% flourished, doubling their sales value in the second year.

Roy concluded: “To remain competitive, brand owners need to make the benefit of the innovation relevant to evolving consumer needs. They need to tap into and market the transformation, not just the product feature. A targeted innovation strategy can help address the relentless search for growth in 2023 and beyond, especially as we continue to see the rules of the consumer goods category being re-written. This evolving innovation eco-system will be the driving force for change across an industry struggling to cope with the changing consumer landscape.”

NAM Implications:

- Having emerged from three years of unprecedented disruption and uncertainty…

- …a slowdown in innovation should come as no surprise.

- (given that most survivors were focused on survival via getting the basics right)

- That said, without innovation, everything goes out of date…

- This means that small and medium-sized manufacturers, being more agile…

- …can have a competitive edge.

- But much depends on having and optimising distribution and supply chain advantages.

- Worth applying the findings in The ‘Race for Resilience: Innovation Pacesetters’ study by Circana…

- …to optimise your innovation initiatives.