Circana has launched its latest biannual FMCG Demand Signals report covering the six largest markets in Europe, with the study confirming that despite a drop in inflation, demand has yet to recover.

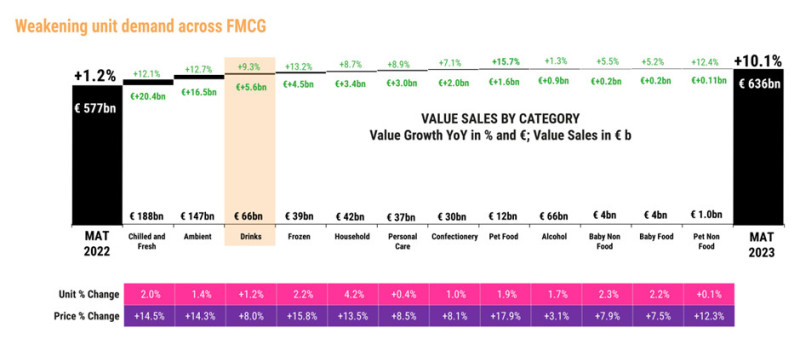

As the gap between prices and unit sales continues to widen, the report – FMCG’s Race for Resilience: Unlocking Growth – highlights how European shoppers are continuing to buy less: unit sales are down 1.3% over the past year. FMCG value sales have soared by a further 10.1% year-on-year to reach €636bn, but this continues to be driven almost entirely by inflation.

“Our latest report brings both good and bad news,” said Ananda Roy, Global SVP, Strategic Growth Insights, Circana.

“Two years post-pandemic and the FMCG sector remains far from normal. Demand has yet to fully recover, and we see more everyday categories becoming discretionary. Private labels continue to gain share from brands, and inflation-fatigued consumers are coping by buying on deal and shopping at the discounters. As global turmoil and uncertainty continue, we expect that FMCG demand will not recover before the second half of 2024.

“The good news is that a return to volume growth is possible and a clear playbook is emerging for how to achieve it. Growth and opportunity exists in the areas of innovation, sustainability and pricing, boosting resilience to future shocks.”

The report highlights that wage growth has converged with falling inflation across the EU6, meaning disposable income has improved slightly, and consumer spending is making a weak recovery. However, uncertainty continues to leave consumers extremely price-sensitive. In the year to end of June 2023, prices grew by an average of 11.6%, causing units to decline by 1.3%. Over the last six months, average prices across FMCG have inched up by one further percentage point, from 11.6% to 12.9%. Circana noted that while this may appear to be a minor increase, it has hit consumers hard, especially as so much of it is focused on everyday food items. As a result, unit decline has worsened significantly, from 1.3% to 2.4%.

Meanwhile, data in the study reveals a 22% drop in new product launches coming to market in the EU6 over the past year, a significant deterioration on the 16.5% decline highlighted in Circana’s May 2023 FMCG Demand Signals report. Less than 1% of NPD represents breakthrough, new-to-world or new-to-category innovation. The overwhelming majority is existing products that have been renovated, reformulated, repackaged or – increasingly – ‘shrinkflated’ and relaunched with new EAN codes. Despite this, there are a small number of innovation ‘superstars’ that account for 56% of value and 40% of unit growth generated by NPD over the past year. The UK in particular, over-indexes on such superstars, with 33% of all superstar launches originating in the UK.

Roy commented: “Brands are understandably cautious about placing bets on risky, new-to-market NPD in the current climate, but retreating from NPD would be seriously short-sighted. The most enterprising brands are already zeroing in on the opportunity from the turmoil and finding new ways to drive demand.”

The report notes that brands are continuing to lose ground to retailers’ private label products. Now accounting for 39% of grocery sales in the EU6, private label is worth €246bn to retailers, having grown its value share by a further 2.2 percentage points in the last year (to June 2023). Two years ago, that share stood at 35%.

Roy said: “High inflation has acted as a catalyst for private label growth, but its success is not due to cheaper prices alone. Private label has become even more premium in recent months and as a result, the price gap between private label and national brands has shrunk – now averaging 15-20% in food categories, down from 28-40% two years ago.

The study also highlights that sustainability-marketed products have struggled to maintain demand since mid-2022. Although budget-conscious consumers want to buy products that are better for the planet, they have had to make difficult choices about how and where to spend their money, which means demand has dropped off. In the short term, Circana expects that demand for more sustainable products will be driven by retailers, primarily due to regulatory requirements such as the European Commission’s Ecodesign for Sustainable Products Regulation (ESPR), which will force them to ask tougher questions about the sustainability credentials of the brands they stock.

In terms of packaging, sustainability is important, but it has become mainstream. In the past twelve months, when making a purchasing decision, 55% of Spanish consumers chose a brand specifically for the packaging. In France, 51% of consumers claim to have switched brands or products because of concerns about the packaging and in Germany, 43% purchased more products in environmentally friendly packaging. In total, nearly half (48.3%) of European consumers have purchased less products packed in plastic in the past year.

Roy commented: “Brands that want to continue to get listings – especially prominent listings – will need to show they’re taking sustainability seriously. Those that want to make sustainability square up with volume growth will need to focus less on isolated ‘green’ initiatives and more on showing how sustainability runs through everything they do.”

He concluded: “At a time when consumers are challenging their own loyalty to existing brands, products and categories, brands and retailers are having to genuinely rethink their businesses and strategies.”

NAM Implications:

- Falling volumes and switching to own-label, discounters and promos in a search for affordable value…

- …means growth has to be at the expense of rivals…

- …via innovation and price in terms of appeal to savvy consumer-shoppers.

- Any alternatives to these options will be very, very expensive in terms of sales and missed opportunities.

- But opportunities abound for those that can work in the heat of the New Norm kitchen.

- Those that need a cooler working environment will have to be content with less…