As pressure on consumer wallets continued to impact volume growth, European grocery retailers joined major brands by increasing promotions for private label ranges. This is one of the key findings from Circana’s latest Demand Signals Category Monitor, which covers the sales of more than 175 FMCG categories and 2,000 product segments across the six largest markets in Europe.

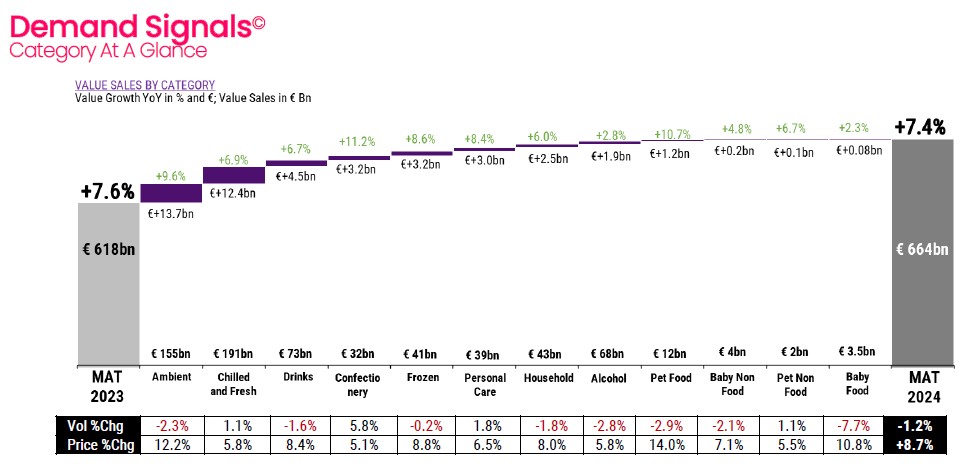

According to the analysis, total FMCG volume sales declined 1.2% over the 12 months to the end of February 2024.

Strategies to boost volume sales by brands and retailers included increasing promotional intensity by 15% compared to the same period in 2023. This slowed the sales decline to 0.3% from 1.4% in the previous month and meant that for the first three months of 2024, volume sales grew marginally by 0.7%. Nonetheless, there was still an overall decline for the full 12-month period.

Circana’s research found that 21% of FMCG goods are now sold on promotion. Despite this, trade efficiency dropped, illustrating that promotions do not always generate volume uplift.

As private label pricing moved closer to national brands – after an extended period of raising prices by retailers and increased promotional intensity by brands – it is still higher than in 2022, suggesting that relative affordability is crucial to maintaining private label sales.

Circana noted that retailers have responded with increased promotions across every channel as they sought to boost weaker-than-expected volume growth. This was particularly pronounced in the discounters, where the volume sold on promotion was up by as much as 68%. Private label promotions increased by 36% in hypermarkets and 25% in supermarkets.

Even with the increase in promotions by retailers, the price gap between private labels and national brands remains narrow, meaning that the savings afforded to shoppers for switching to private labels is reducing.

“Reflecting on the response to growing volume losses back in 2023, we can see that it was the national brands that fired the promotional starting gun all along,” commented Ananda Roy, Senior Vice President of Strategic Growth Insights EMEA, Circana.

“As a result, strategy-obsessed and consumer-focused retailers followed. However, as both manufacturers and retailers rush to shore up volumes by reducing prices and increasing promotions, the intended effect is likely to be dampened by high absolute prices, low innovation, competitive response and growing private label penetration.

“Over-saturating shelves with deep deals only risks increasing subsidisation. Volume uplift from promotions tends to be short-lived and put simply, ‘more of the same’ is not a solid volume growth strategy. True volume growth is unlikely to return until the end of this year, especially if it is based on more of the same. Manufacturers and retailers must look to organic growth through shopper activation, brand experience and one of marketing’s most dynamic levers, innovation.”

Despite higher prices, the data shows shoppers continue to favour private label – volume sales grew to 64% in total FMCG in the year to date, up two percentage points compared to 2023. The 3.6% volume growth compares favourably to the volume sales decline seen by national brands that lost 3.9%.

Other highlights from Circana’s Demand Signals Category Monitor include:

- The UK was the only market to post both volume and unit sales decline as growing private label sales did not offset volume losses in national brands. The Netherlands joined Spain, Germany, and France in growing volume in YTD compared with a year ago; responding to lower inflation.

- National brands carried more promoted volume across channels where their promotional volume share in the discounters was as high as 40%, 34% in hypermarkets, 32% in supermarkets and 28% in convenience channels.

- Private label penetration is low in alcohol, confectionary and drinks categories where image, equity and NPD have propelled brands forward. Baby food and household care categories were revealed as those most vulnerable, with private label unit share growth of 3.2 and 2 percentage points respectively. Champagne, frozen poultry and meat substitutes were the top promoted segments with around 50% promoted volume. The top 5 segments that drove unit sales decline were chocolates (-52m), juices (-39m), chilled/fresh desserts (-30m), pet food (-26m) and ambient desserts (-26m). With chocolate among the top segments for value growth, significant unit sales decline suggests downtrading to lower priced or private label options.

- Among edible categories, the unit sales decline slowed to -0.3% in the year to Feb’24 from -1.4% in Jan ’24; while in non-edibles, unit sales grew 0.5% driven by growth in Household & Personal Care and smaller packs to boost sales in discretionary segments.

- Value sales in the year to Feb’24 grew 2.7%, up 100 basis points in one month, as volume prices rose 1.9% in the corresponding period. Absolute prices remained high, impacting sales.

- The top 5 segments for value growth were Chocolates (+€185m), Laundry Detergents & Aids (+€156m), Chilled/Fresh Meat (+€143m), Cooking Oil (+€135m) and Chilled/Fresh Vegetables (+€114m).

NAM Implications:

- The standout insight indicates that consumers are still in uncertain but savvy buyer mode…

- …unwilling to spend beyond their means, despite incentives.

- The issue for national brands has to be to what extent will shoppers discover that good quality own-label stands comparison with branded equivalent…

- …making it increasingly difficult to win them back to the brand.

- (more opportunity for Retail Media?)

- BTW, this comprehensive Circana report is well worth a line by line comparison across your total assortment and territories…