75% of Gen Z say they are the ‘decision makers’ on what personal care products their household should purchase. This is despite four in five Gen Z consumers still living in a family unit at home.

This is according to new study from NIQ (previously known as NielsenIQ), titled ‘Gen Z No filter!’, which polled Gen Z consumers aged between 18-25. 1,000 consumers were surveyed in each of the seven European countries surveyed, including the UK.

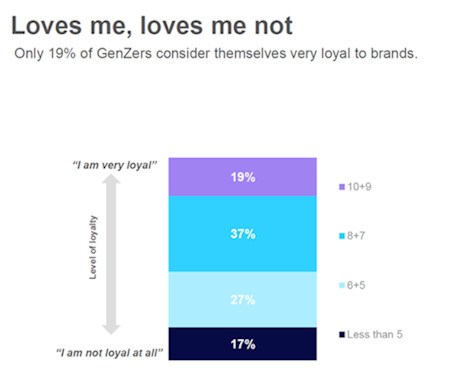

The data reveals that, on average across the markets, more than half (53%) have this decision-making power in FMCG, with only 19% of Gen Z consumers admitting to being very loyal to FMCG brands.

However, this is different across individual markets – for example, German Gen Z shoppers are significantly more autonomous in their decision-making process compared with Italy, Spain, and Portugal, where Gen Z consumers count heavily on their parent’s purchasing and making decisions about Personal Care and Food products. In the UK, NIQ data showed that Gen Z is especially dependent on parents for making decisions on food products.

NIQ also found that, on average, among those making purchasing decisions, 23% of Gen Z state that the first item on average that they purchase is in the beauty category. This is above other categories such as basic groceries, impulse purchases and hygiene and personal care.

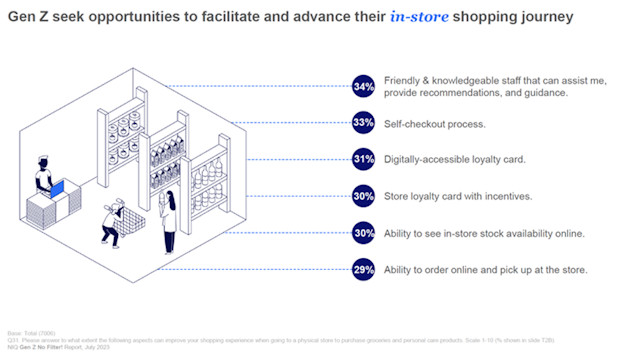

Moreover, there is a greater mix in where European Gen Z consumers choose to shop for FMCG and personal care products. Despite many personal care brands embracing digital channels to target this demographic, NIQ found that over half (51%) prefer to shop in-store, followed by 43% shopping omnichannel and just 5% preferring online only.

The survey delved into what makes the in-store shopping experience more beneficial for Gen Z consumers. The data revealed that the majority of Gen Z highly value recommendations from friendly in-store staff (34%). Gen Z also seek convenience to enrich their shopping experience: 33% of respondents claimed self-checkouts would improve their shopping experience, while 31% claimed digitally-accessible loyalty cards would be a further draw.

Vasi Dragomir, Consumer Insights Commercial Activation Manager at NIQ, commented: “While navigating through the evolving preferences and mindset of GenZers, we noticed that they are very dynamic in their choices and preferences. Their relationship with various categories within the FMCG and Personal Care spectrum is evolving constantly and will continue to be influenced as they transition through the different life stages.”

She added: “It is imperative to anchor ourselves into the broader context and the concept of ‘liminality’. Liminality is a state of transition or in-betweenness, the undefined space between what it is and what will happen next. And this is what defines Gen Z as they are evolving to shape their identity and entering adulthood. They are not fixated on their choices but are constantly evolving and adapting, making it essential for brands to stay agile and responsive to their changing needs and values and thus should look to cement their relationship with these young shoppers in a meaningful way.”

NAM Implications:

- Taking these NIQ at face value…

- …it is worth you and your colleagues exploring local-level impacts on your categories…

- …in order to bench-test brand strategies.

- Unless you prefer to await the retail audit figures?