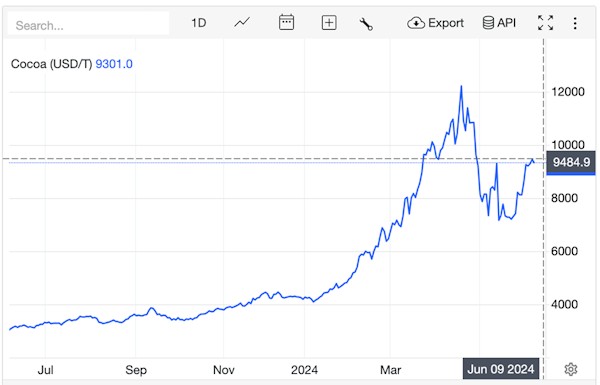

Cocoa prices have risen 207% over the last year (to 5 June 24), with the vast majority of increases being in the last five months.

Weather has been causing drier conditions in Ghana and Ivory Coast, which are the world’s two biggest producers of cocoa beans accounting for some 60% of production. In addition, “Cocoa prices are rising due to a global supply shortage, chronic underinvestment in cocoa farms and investor speculation” – JP Morgan.

The impact is more pronounced longer term. This increase is unprecedented.

What has this meant for the UK consumer?

Very little, for now at least.

Food inflation to the end of March 2024 is 4% (down from 19% the year before).

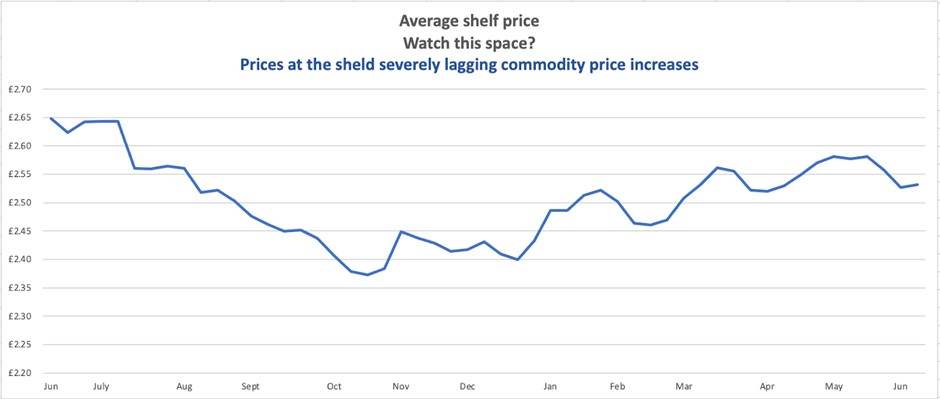

Shelf prices for chocolate products with a relatively high cocoa content is slightly down year-on-year (June 24), with the majority of increases happening since December 23:

Products included are those with a relatively high cocoa content. Brands include Greens & Blacks, Lindt, Hotel Chocolat, and own-label with 60%+ cocoa, as examples.

The average price of all chocolate bars, blocks and biscuits rose 4.5% over the same period. However, there has been negligible increases since December 2023 and therefore no discernible impact of rising cocoa prices on the price consumers are paying!

What manufacturers are leading price increases?

We often see manufacturers waiting for their peers to lead price increases for fear of losing volume and share short term. At the current time there are no obvious leaders of price increases – suppliers or retailers.

Is the consumer seeing shrinkflation?

No. Price increases are not being disguised by shrinking sizes over the period.

What’s next?

It is inconceivable that prices to the consumer will remain unchanged over the next two years. Products with high cocoa content will see increases in price, reduction in size or re-engineering of recipes, potentially a mix of these initiatives.

Meanwhile, enjoy these more affordable luxurious moments!

For further insights, contact Brand Nudge at [email protected]