Kantar has released its Brand Footprint report for 2024, which ranks the most chosen FMCG brands by shoppers in Ireland.

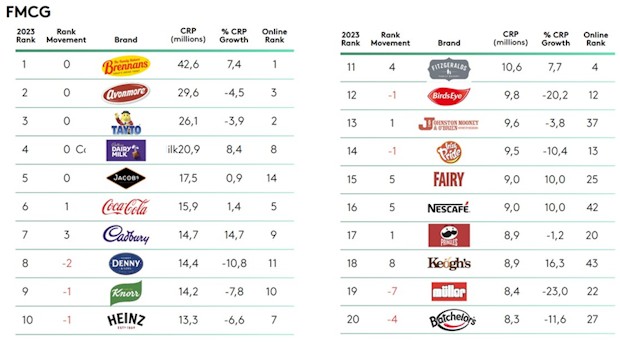

The top five have remained unchanged, with Brennans leading in the first position, followed by Avonmore, Tayto, Cadbury’s Dairy Milk and Jacob’s. Local brands are the majority in the ranking this year, showing that trusted products still have space in Irish households.

Irish households purchased an average of 77 brands over the course of the year. The brands that gained or maintained their positions in the ranking were those that invested in new product development and innovative ways to promote their products.

For example, Crackers brand Jacob’s doubled down on new innovations last year to broaden its appeal with consumers. This included the release of two unique flavour combinations – a new cheese and pickle flavour for its classic cheddars range, and a new rosemary flavour for its Mediterranean range. The innovations are said to have opened up new opportunities for savoury treats to be consumed during the day and helped the brand remain present in many Irish households.

Within the wider top brands ranking, bottled water brand Ballygowan broke into the top 100 for the first time, reaching number 81, by soaring 32 positions due to an increase in its range of flavoured sugar-free water and the awareness generated by a partnership with the Irish Rugby Football Union (IRFU). Its presence in Irish households increased by 17.2% after they become the official water partner of the IRFU.

Guinness, which launched its non-alcoholic 0.0 beer alongside its biggest-ever responsible drinking campaign in Ireland, also soared in the rankings. It climbed 21 positions, achieving number 87 in the total FMCG ranking.

Innovation focusing on different shoppers’ needs was also key this year for Flahavan’s, an Irish oat company, which launched its gluten-free jumbo oats, appealing to coeliac or gluten-intolerant shoppers. The new product was well received by consumers and helped to increase their presence in Irish households by 38.5%, climbing two positions in the ranking to number 34.

Appealing to shoppers changing dietary needs, Philadelphia expanded its cream cheese line by launching three new plant-based flavours for vegan and lactose-intolerant shoppers. The products were responsible for increasing Philadelphia’s presence in Irish consumers’ baskets by 30.2%, climbing 17 positions to reach 87 in the ranking.

Emer Healy, Business Development Director at Kantar, commented: “Even in a cost-of-living crisis, Irish shoppers are still prioritising the brands they know and love, especially those that are innovating or providing small luxuries within their budgets.

“When we look beyond the top five ranking, we can see that brands focused on meeting changing consumer needs are making it into the basket more often.”

NAM Implications:

- The population are very brand loyal, despite cost-of-living pressures…

- …the downside is that if a retailer can induce a switch to own-label…

- …shoppers might prove equally difficult to win back to brands.

- Hence brand owners’ willingness to invest in ways of maintaining brand loyalty.

- All else is detail…