Smaller consumer packaged goods (CPG) manufacturers are innovating at scale to create ‘Superstar’ products, with average sales per innovation higher for small and medium-sized brands than large ones. Tapping into local and sustainability claims, and shoppers’ desire for products that excite, inspire and support their lifestyle, smaller challenger brands are highly effective in driving sales revenue through innovation – proving the old adage that ‘small is mighty’.

This is according to the ‘Europe’s Innovation Pacesetters 2025’ report published today by Circana – a study of 75,000+ new CPG product launches and renovations in 2024, including food, drink, household, personal care, baby and pet products. The report analyses point-of-sale data from Circana’s largest European markets – France, Germany, Italy, the Netherlands, Spain and the UK (EU6) – and draws on consumer research to understand purchasing behaviour.

Across Europe, ongoing geopolitical and economic uncertainty, coupled with inflation, has led to an overall decline in CPG innovation. The number of innovations fell by 20% compared to 2023, while sales from new products were down 17%, from €28.9bn in 2023 to €24.1bn in 2024. Only 5.2% of all CPG products were innovations last year, down from 6.2% the previous year; one of the lowest levels ever recorded by Circana.

The UK and the Netherlands had the highest inflation rates and so suffered the biggest innovation declines in terms of value sales. The UK saw sales of innovations in edibles categories decline 28% between 2023 and 2024, while the Netherlands fell 43% over the same period. However, the UK remains the most important market for innovation, with 7% of new edible product sales coming from new product development (NPD), the highest of the EU6.

“Innovation is the lifeblood of CPG, a proven source of growth and a way of delighting shoppers who are eager for new products at a time of cost-cutting and uncertainty,” commented Ananda Roy, Senior Vice President and Industry Advisor, Consumer Goods, Circana.

“Despite NPD declining year-on-year in all years since the pandemic, as companies focus on optimising their portfolios and using shrinkflation to boost sales, there are significant pockets of growth among smaller and challenger brands and among some of our best-loved heritage brands reinventing themselves.”

Circana’s analysis also reveals that new products perform better in their second year of launch as shoppers try them out, any distribution issues are sorted, and price adjustments are made. Innovative product launches that were ‘Rising Stars’ (making €500,000 to €1m in sales per SKU) or ‘Mainstream’ (€100,000 to €500,000) in their first year often upgraded to become Superstars (making more than €1m) by their second year.

Report highlights:

Small is big: From organic chicken to Scottish vodka

In 2024, smaller CPG manufacturers innovated at scale, with NPD contributing as much as 79% to one brand’s total sales. Average sales per innovation were higher for extra small, small and medium-sized manufacturers than for large ones, with smaller companies’ overall contribution to NPD growing.

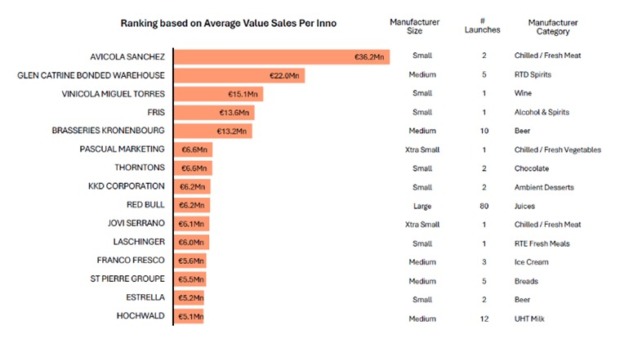

Spanish, family-run food business, Avícola Sánchez, tops the Most Innovative Manufacturers 2024 ranking (based on average value sales per innovation). Known for its Avicosan Organic Chicken, the firm generated sales of €36m per innovation. In another instance, disruptive spirits brand, Glen’s Vodka, which leans heavily into its Scottish roots, generated sales of €22m per innovation.

With manufacturers ranked based on Average Value Sales per Innovation, ‘Small’ and ‘Medium’ sized players feature in the top 15 innovative manufacturers

Source: Circana

Trusted heritage brands embrace reinvention

Heritage brands are reinventing themselves through a combination of diversification, collaboration and TikTok inspiration to rejuvenate, re-energise and redefine categories.

Private label makes shopping fun again!

Many private label launches are now brands in their own right, with retailers across Europe experimenting with new routes to market, product and services bundles, and pricing strategies to help to make the shopper experience more enjoyable.

Roy said: “Consumers love new products that fit their lifestyle and dietary choices – and help them to meet their lifestyle goals. They’re prepared to pay more for items that offer something genuinely different. But making sure new products live up to expectations is crucial – otherwise consumers will ‘silently quit’. The message to CPG manufacturers and brands is clear and simple: now is the time to innovate.”

Six innovation trends influencing consumers:

- Plant-based foods in innovative flavours, upcycled ingredients (e.g. wonky fruit) and refill systems or fast laundry detergent help consumers choose ethical products.

- Growing demand for dark and flavoured chocolate bars, with innovative packaging.

- Health and wellness focus, with premium and hypertonic energy drinks meeting demand for enhanced nutrition in convenient formats.

- Manufacturers adding proteins and vitamins, and empowered health trends such as microbiomes and weight loss (including GLP-1 inspired products).

- Global cuisine inspiration, such as the viral confectionery, Dubai Chocolate.

- Familiar brands come with a twist, such as protein drinks with coffee.

To access the full findings from Europe’s Innovation Pacesetters 2025, download the report here

NAM Implications:

- Retail being a ‘try it and see’ medium suggests the only real way of progressing.

- And small and medium-sized companies tending to be less constrained by mega-brand heritage suggests that the big brands are at a disadvantage.

- Leaving an opportunity for those suppliers that have the means and ability to test sufficiently to go full scale.

- (Meanwhile, the fact that own-label is innovating ahead of brands will be of concern to some…)