Despite around 14% (4.1m) of households in the UK containing a vegan, vegetarian, pescatarian or flexitarian, the current consumer focus on value and price points has weakened the plant-based category.

This is according to data from NIQ (formerly NielsenIQ) in its new report – Flexitarianism: from niche to mainstream – which looks into the spending and consumption habits of consumers that follow vegan, vegetarian, pescatarian or flexitarian diets.

The study reveals that amid the cost of living crisis, some categories are struggling for growth as cost pressures rise: 3 out of every 4 (73%) plant-diet shoppers are actively trying to make savings on their grocery bills, with buying into promotions (62%) their preferred way to do this.

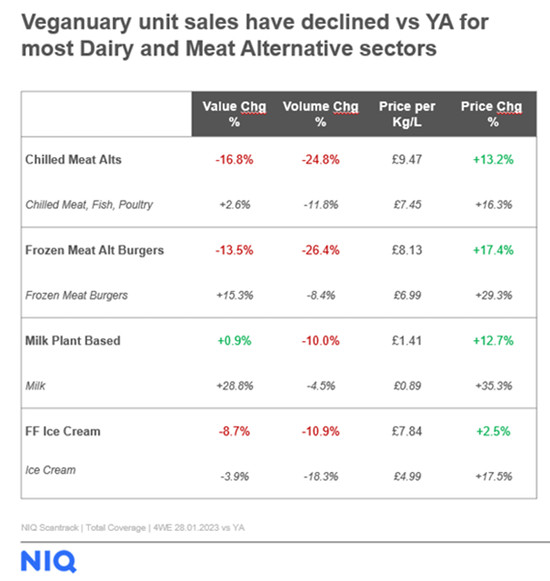

The data from NIQ shows that alternatives still cost significantly more than the standard range (despite slower inflation), and it is likely that shoppers are becoming more price sensitive in the current challenging economic conditions. Veganuary – traditionally a time for shoppers to switch to dairy and meat alternative diets – resulted in a decline in unit sales for most dairy and meat alternative categories in January 2023 compared with the same period last year.

The study also found that when shopping for plant-based alternative products, the discounters are making rapid gains. Aldi’s MAT value share of dairy and meat alternatives this year rose to 7.7%, whilst Lidl hit 5.4%, compared with the other grocery retailers where sales either remained the same or declined.

However, NIQ noted that there still remains a big market opportunity for plant-based products, with data showing that 38% of the UK population are replacing meals containing meat with vegan or vegetarian alternatives at least once a week. They are also turning to plant-based categories when looking to indulge, with value sales for Magnum Vegan ice cream up 7% compared with two years ago, while value sales of Little Moons have surged 2,168% compared with two years ago.

Moreover, NIQ’s data showed that 55% of plant-based shoppers say sustainability is important to them, while 72% say looking after their household’s health is very important. Over half (52%) buy new product developments (NPD) once a month or more, suggesting that retailers and brands should focus on innovation as well as these core trends to ensure they are targeting plant-based shoppers effectively.

“UK consumers are being faced with challenging economic pressures, and price is an important factor dissuading flexible eaters from buying into meat and dairy alternatives, in the current climate. This is reflected in the impact Veganuary had in driving new interest this year, with retailer focus being more on overall price messaging, which impacted sales during this period,” said Katrina Bishop, UK Thought Leadership Activation Manager at NIQ.

“However, there continues to be a market for plant-based alternatives, and many consumers are still reducing the amount of meat they eat, so it is important to appeal to flexitarians as well as those with vegan or vegetarian diets. Messaging is therefore key – bringing the out-of-home occasion inside can save money, even with premium products, and consumers are still willing to spend on occasional indulgent treats. It’s also crucial to pay closer attention to your target consumer – messages around health and sustainability resonate strongly with shoppers who are regularly eating a more plant-based diet, so focus on ensuring these are clear when promoting such products to shoppers.”