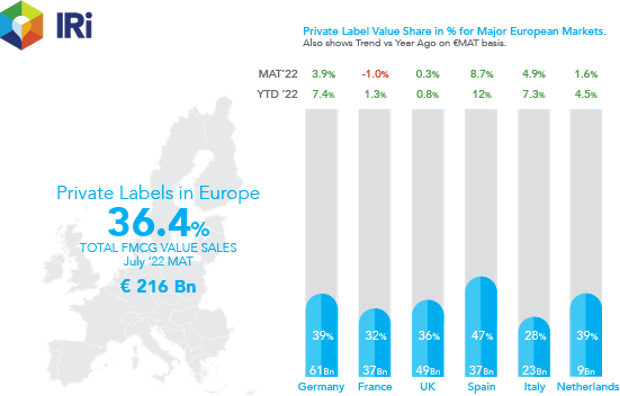

The latest biannual ‘FMCG Demand Signals’ report from IRI has revealed that private label now makes up 36% of total FMCG value sales in Europe (€216bn) – up from 34% earlier this year. A majority of consumers were also found to believe that private label is as good as national brands, with retailers’ own ranges becoming key competitors in several FMCG categories.

Strong performance has taken place across all European markets, particularly in Spain where private label now accounts for 47% of total FMCG value sales, followed by Germany and The Netherlands (both at 39%). The UK and Germany continue to lead private label sales in absolute value.

The report confirms that fewer promotions by retailers post-pandemic have made way for a targeted return to lower everyday prices across a basket of 150 consumer staples this year to help mitigate the impact of food price inflation. Retailers are trying to manage the impact of rising prices by optimising the range, pack sizes and price points, but strategies differ by category and value tier – and one of the biggest beneficiaries has been private label.

“Private label has traditionally offered lower prices to shoppers,” said Ananda Roy, Global SVP, Strategic Growth Insights, IRI. “But these are not sustainable and inflationary price rises have been greater than on well-recognised brand names. Yet this has not dampened demand, especially in the Chilled and Fresh, Ambient and Frozen segments in food categories, and Household and Personal Care in non-food categories.

“Our research has shown this is because around 60% of consumers believe that private label is as good as national brands on quality, innovativeness, sustainability, trust and delivering on claims, with 25% saying some private label is ‘even better’ than national brands. This is a significant shift from previous periods.”

The report notes that private label is poised to be the ‘third competitor’ to national brands in several FMCG categories, having transformed to strategy-led, data-driven & differentiated substitutes. Their ability to grow value, volume and attract new consumers is a growing risk to smaller and mid-sized manufacturers – the ‘squeezed middle’ – who could begin to struggle to match private label products competitively as economic conditions worsen. IRI anticipates that a price war is increasingly likely in early 2023 and thereafter as the outlook for FMCG demand darkens.

Meanwhile, the study highlights that throughout the pandemic, national brands outperformed private label – with consumers feeling comforted by buying brands they knew, trusted and could easily find in-store or online in challenging times. In the current inflationary environment, private label is returning to pre-pandemic levels as consumers question their loyalty to national brands, and retailers expand their range of innovative and well-priced options.

Discounters have also expanded their portfolio of small-format stores in town centres and residential neighbourhoods, making these products available to a wider group of consumers who may not have been willing to travel to out-of-town stores previously. This has led to value sales growing 5.4% in the year-to-date 2022 (+3.0% MAT 2022).

IRI found that the growth in 2022 is being primarily driven by food categories (+5.3%), taking its contribution to €191bn, with Chilled & Fresh, Frozen and Beverage categories increasing. Notably, Alcohol saw a decline of 5% or £3.4bn in value sales to July 22 in comparison to a year ago and 6.7% in the year-to-date 2022.

Non-edible private label is growing at pace in two of the biggest private label markets – Germany & Spain – and across Europe at three times the speed of the total private labels market in the last four weeks alone, delivering €25bn.

NAM Implications:

- As the full cost-of-living increases bite…

- …and brand loyals seek equivalent products from trusted retailers…

- ..in a must-have search for value.

- Brands can only market themselves harder…

- …Vs both rival brands and ‘their third competitor’…

- ..a private label as good as, or better than the brand.

- Anything less is denial…