Figures compiled by the Food and Drink Federation (FDF) show there was a resurgence in food and drink exports from the UK last year, with most categories now exceeding pre-pandemic levels to reach a record total of £24.8bn.

Exports to Europe rose 22% to £13.7bn, and developing markets also did well, with fast-growing economies like Vietnam nearly doubling. For the first time, exports to non-EU markets broke through the £10bn barrier, hitting £11.1bn.

While supply chain disruption and high energy bills have played a part in the rise in value of UK exports, there was also strong volume growth in most product categories over the last 12 months. The FDF suggested that this showed that the global appetite for high-quality UK food and drink products continues to grow around the world.

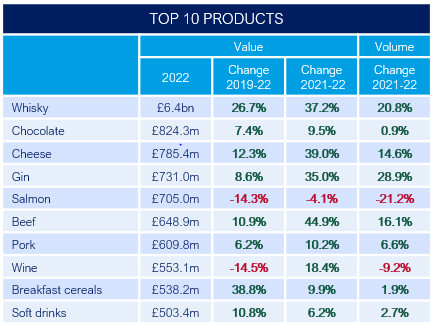

Chocolate remained the UK’s top food export last year, worth £824m, but there are indications that this could be overtaken by cheese this year after achieving rapid growth in overseas sales.

The FDF’s Head of International Trade, Dominic Goudie said: “UK food and drink continues to be recognised around the globe for its high quality, safety, and sustainability credentials, with demand as strong as ever across the EU and at record levels in developing markets. As the UK’s largest manufacturing sector, dynamic trade is vital if our sector is to deliver the robust growth we’d like it to in the coming months and years, benefitting communities in every part of the UK.

“Imports are essential for the success our sector, adding value to UK produce while ensuring consistent availability and value for shoppers. There also remains substantial opportunities to deliver further export growth, but this will require government to use all the trade policy levers at its disposal in support of the food and drink sector, to ensure that our producers can access competitively priced ingredients and sell into the fastest-growing markets.”

UK Food and Drink Exporters Association director Nicola Thomas added: “We are encouraged to see the increasing demand for British products in emerging markets such as Vietnam and the MINT territories which are helping to up new sales avenues for our more established exporters; in addition, recent FDEA research among our network of overseas in-market partners highlights a wide range of product categories in almost universal demand including snacking, non-alcoholic drinks, health & wellness, dairy and private label. There is huge scope for UK companies to seize further opportunities in 2023.”