IGD has published its latest Viewpoint report, which discusses the UK’s relative stability as it contends with a weak economy and new geopolitical threats from the US.

The report – A Shaky Start to 2025, what’s next? – states that the political position in the UK is arguably the most stable it has been for nearly a decade, although a threat to global trade could emerge from the US with the new administration’s trade policies.

While President Trump’s approach to import/export tariffs risks escalating trade disputes, IGD notes the broader impacts of this could indirectly threaten the UK food system at a time of slow growth, persistent inflation and tentative recovery.

James Walton, Chief Economist at IGD, commented: “President Trump advocates for tariffs to protect US industry. If he implements new tariffs in his second term, UK food and drink businesses may be impacted. However, the US is not a primary partner for UK trade. While the short-term impact may be challenging for some, the longer-term effects will depend on how the global trade environment evolves and how businesses respond to changing geopolitical and economic conditions.”

The report shows a domestic picture of tentative recovery as 2025 kicked off with muted business and shopper confidence and slow growth in GDP.

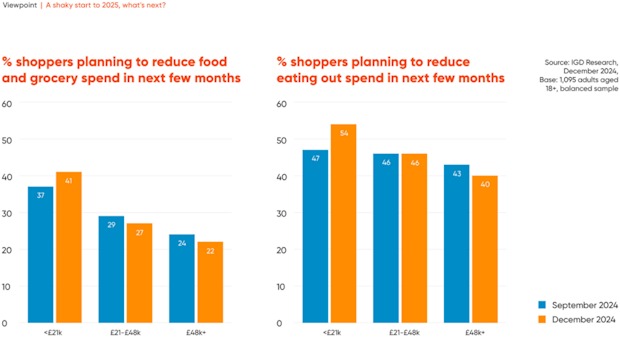

Michael Freedman, Head of Economic and Consumer Insight at IGD, said: “The current combination of weak growth and inflation is a difficult one, threatening stagflation, which is hard to deal with via monetary policy. Shoppers have become accustomed to saving money with loyalty cards and buying more products on promotion, with lower-income groups planning to cut back their grocery and eating out spend. As many as 81% of Shoppers expect food prices to increase (+4% vs Sep’24) and 63% plan to use loyalty cards more (+4% vs Dec’23).”

IGD noted that pressures on food businesses are coming from many directions, with inflation particularly rising in the away-from-home sector, where labour costs are increasing alongside labour demand. Added to these challenges are the pressures of legislative compliance. The long-awaited Extended Producer Responsibility (EPR) scheme is due to come into effect in October, transferring the environmental impact costs of packaging to manufacturers.

On a positive note, the report highlights that the new government has shown an appetite for putting a new strategy in place that could leverage the UK’s political stability to power sustainable growth.

Matthew Stoughton-Harris, Head of Corporate Affairs at IGD, concluded: “Domestic political stability provides the government with an opportunity to deliver against its strategic vision as set out towards the end of 2024, through the Plan for Change and Industrial Strategy. The new food strategy is a significant step in the new government’s approach to the food system and, once defined, is likely to shape our food system for years to come.’”

IGD stated that although current government plans may not yet consider the rapidly changing geopolitical landscape, a food strategy co-created by industry and government would provide a significant opportunity to boost resilience and unlock growth opportunities across the whole system, including supporting shoppers towards healthy and sustainable choices.