A new survey by Shopmium has found that 80% of British shoppers are now budgeting for groceries or monitoring their spending more carefully as the cost-of-living crisis continues to bite.

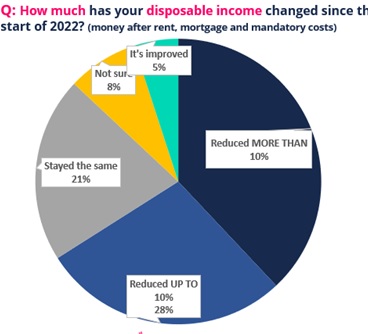

The survey of over 2,000 UK consumers by the supermarket media and promotions business also found that 66% of consumers have experienced a decline in their disposable income since the start of the year, with 38% saying it has reduced by more than 10%.

Brits buying fewer branded products as inflation rises

Brits buying fewer branded products as inflation rises

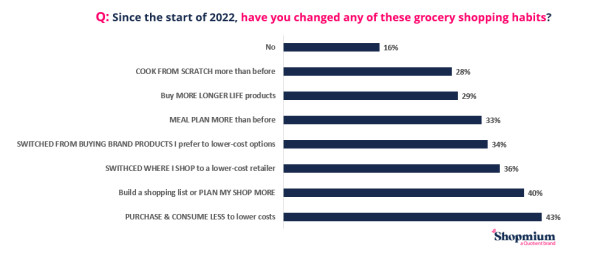

Shopmium found a noticeable difference in the cost of groceries, with 56% of Brits saying they spend more on their weekly shop now than they did in 2021. The average spend is £65 per week, but for families with children at home this rises to £81. The additional cost of supermarket goods has led many consumers to change their shopping habits. In addition to buying and eating less, 36% have switched to a lower cost retailer and 34% are switching to cheaper options such as supermarket own brand items. There has also been a move away from products with a short shelf life, with 29% now actively seeking longer life food and drink items.

Under 25s most affected by inflation

Younger generations are the most affected by inflation and have been forced to change their shopping habits more drastically than those in other age categories. 52% of Brits aged 25 and under are buying and eating less, and 55% – more than any other age range – are writing shopping lists and planning their weekly shops. Under 25s are also the most likely to ditch branded products in favour of cheaper items (46%) and to have switched to a lower cost retailer (45%).

Home cooking takes precedence over eating out and takeaways

The cost-of-living crisis has also impacted Brits’ eating out habits, with 50% saying they plan to eat at home more over the next few months. This is not good news for food delivery services like Uber Eats and Deliveroo though, as 61% plan to order less takeaways to help save money. UK households are replacing meals out and ordering in with home cooking as 64% of people say they now plan their meals in advance, and 28% are cooking from scratch more frequently.

Alcohol and snacks ditched as Brits budget

The category most impacted by UK consumers tightening their belts is alcohol, with 40% saying they have bought less or stopped buying alcohol altogether, with under 34s the most likely (44%) to have done so. There has also been a significant reduction in the amount of sweets and snacks that households are buying, with 37% purchasing less, while 31% have stopped or reduced the number of ready meals they buy. Additionally, 27% have also made cutbacks on health and beauty products, while 21% are buying less meat and fish.

Brand switching highest among household cleaning products

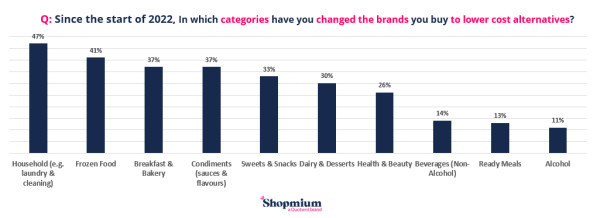

The brands that have been most impacted by changing shopping habits are household laundry and cleaning products. 47% have moved away from the brands they once used to lower cost options. Frozen food has also taken a hit, with 41% now selecting cheaper frozen items such as supermarket own brand pizzas and ice cream. Many Brits have also changed what they eat for breakfast, as 37% have switched from branded bakery items and breakfast cereals to alternatives that don’t break the bank.

What keeps Brits buying certain brands

Food and drink brands have undeniably taken a hit in the cost-of-living crisis but when it comes to selecting similarly priced items in store, there are certain aspects that standout for consumers and keep them buying brands. Shoppers will be most likely to select a brand if it’s a product they trust or buy regularly, but 40% also said they would select a branded product if it’s on promotion and they can get it at a cheaper price than usual. With cost being a big concern for consumers currently, 45% said they would still be willing to buy a brand if it altered the taste or effectiveness of a product, providing that item had a lower price point.

Stuart Sankey, Head of Shopmium UK, said: “It goes without saying that times are hard for UK consumers. The rise in inflation means the majority of households have had to budget or more carefully monitor their weekly supermarket shop, and we’re seeing significant changes to food and drink purchasing habits as people bid to save pennies where they can.

“Unfortunately, it seems there is little the government will do in the short-term to ease the situation for UK households, but what our research shows us is that there is a significant opportunity for brands to respond to consumers’ changing needs and preferences. With price being the key concern for the majority of consumers, and particularly those aged 35 and under, many of whom are already switching to cheaper food and drinks products, brands face tough competition to remain in the basket. While it may not be viable for brands to reduce the price of their range across the board, it would be wise to consider running promotions on the items consumers are most likely to switch such as frozen foods and breakfast cereals, or on the products they’re specifically seeking such as home cooking ingredients or longer life items.

“Brands should also use the current economic crisis to inform their NPD. Given a considerable number of consumers said they would be willing to buy products from a brand if they are cheaper, regardless of whether the taste or effectiveness is altered, brands should focus their efforts on producing more affordable items that mean consumers will still be able to enjoy the brands they know and love, without breaking the bank.”