Latest figures from Kantar show that take-home grocery sales in Ireland grew by 16.3% in the 12 weeks to 21 February. And growth accelerated during the past month to 17.7%, the highest level since November 2020, as shoppers spent an additional €151.1m feeding themselves at home.

With it almost a year since the first national lockdown in Ireland, Kantar’s data shows the months of hospitality venue closures and working from home has meant an extra €2bn spent on take-home groceries. On average, Irish consumer’s household grocery bill has increased by €1,000 over the year.

However, with social distancing and limits on gatherings continuing, the data highlights the negative impact in other categories. Sales of shampoo were down 0.8% and conditioner 2.7% in the past 12 weeks, whilst deodorant sales slipped 5.4%. Staying at home more and an emphasis on hygiene has also meant a steep decline in sales of cold and flu remedies, with cold treatments falling 55% and cough liquids down 60%.

February brought Valentines’ Day and Shrove Tuesday, and consumers continued to make the most of such events. They spent an additional €3.2 m on boxed chocolates and sales of flour, eggs and syrup grew by 56%, 21% and 14% respectively for Pancake Day.

Online grocery sales had another record-breaking month as shoppers in Ireland ordered €63m worth of take-home groceries, accounting for 6.3% of all sales. Emer Healy, retail analyst at Kantar, commented: “Online’s share of the grocery market has had an extraordinary uplift compared with the pre-pandemic level of 2.7%. Lockdown may well have converted some previously reluctant digital customers long term – 241,500 people made an order in February, compared with 114,800 last year. They are also using services more often, completing 21.7% more digital orders a month.”

With schools in Ireland beginning a phased reopening from the start of March and hopes of a return of the hospitality sector, Kantar expects these changes to impact take-home grocery sales in the coming months. Healy said: “The 12-month milestone is significant for retailers as it means we start to compare sales against the record-breaking levels of the start of the pandemic in March 2020, and we will see year-on-year growth decline from next month as a result.

“Children heading back to school will be welcome news for exhausted parents and will also mean demand for take-home groceries starts to ease, something that will likely accelerate once offices and restaurants return. We’ll see more typical sales patterns remerge and we’ll need to keep an eye on other metrics of performance to gauge how retailers are moving out of lockdown, including market share figures.”

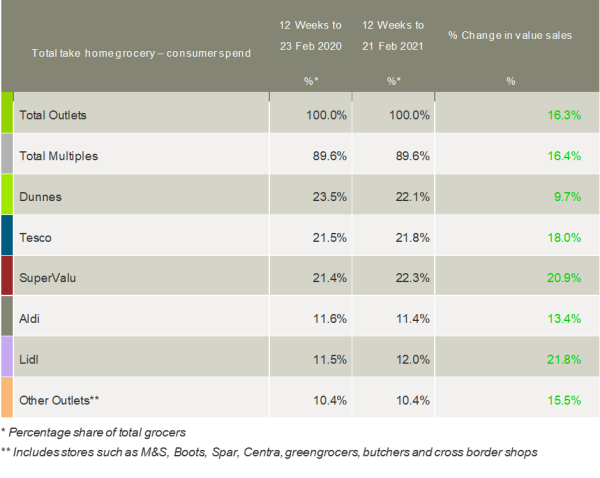

SuperValu sits at the top of the table this month as it grew sales by 20.9% to hold a 22.3% share of the market – an increase of 0.9 percentage points. It was the only retailer to attract new shoppers into its stores and its customers traded up when they were there – spending €70m more on branded goods than this time last year.

Dunnes increased its sales by 9.7% this period as its customers picked up extra items in store and continued to spend more per buyer than at any other retailer at €618.60. This totalled an additional €62.5m spent over the 12 weeks.

Lidl was once again the fastest-growing retailer at 21.8%, with basket sizes increasing by 14.9% year-on-year. Aldi customers spent an additional €57.1m this period, driving 13.4% growth.

Tesco shoppers added an additional 3.6 items to their baskets this period, more than customers at any other retailer, and helped the grocer’s overall sales to rise by 18.0%.

NAM Implications:

- How much NI trade loss has contributed to that in the border counties?

- …as the garda stopped traffic on the main roads.

- Key is how your sales compared, by channel ánd retailer.

- Also, the issue of an Aldi vs Lidl price-fight has to be considered…