Latest data from Kantar confirms that the shift to value-orientated supermarket chains and own-label is continuing as grocery price inflation shows no signs of slowing.

Take-home grocery sales increased by 4.8% in the 12 weeks to 2 October as inflation rose to 13.9% – another record high since Kantar began tracking prices during the 2008 financial crash.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “The cost-of-living crisis is still hitting people hard at the checkouts and this latest data will make tough reading for many. Based on our numbers, the average household is facing a £643 jump in their annual grocery bill to £5,265 if they continue to buy the same items. Taking that at a basket level, that’s an extra £3.04 on top of the cost of the average shopping trip last year which was £21.89.

“Of course, consumers are looking for ways to manage budgets and to avoid paying more for their shopping. We’re generally reluctant to change what we eat, so this is more about sticking to the food we know and love while hunting for cheaper alternatives like supermarkets’ own-label goods. We aren’t seeing dramatic evidence of diets changing. For example, while frozen veg sales have gone up slightly, there hasn’t been a big switch away from fresh products, which are still worth ten times more.”

Own-label sales increased by 8.1% this month, while branded items declined by 0.7%. McKevitt noted that shoppers were also finding other ways to get the items they want for less. He explained: “People are pretty savvy at seeking out best value and retailers are expanding their ranges to help them do this. We’ve seen grocers making a virtue of visually imperfect fruit and vegetables in recent years, allowing them to carry on offering the fresh products consumers want but at a lower price. Many shoppers have been converted and sales of ranges like Tesco Perfectly Imperfect or Morrisons Naturally Wonky were up collectively by 38% this month.”

Meanwhile, with an eye on rising energy bills, shoppers appear to be searching for cheaper ways to cook by avoiding using their ovens. Sales of cooking appliances, including slow cookers, air fryers and sandwich makers, which generally use less energy, were up by 53%. Sales of duvets and electric blankets also grew by 8%, while candles increased by 9%, suggesting people may be preparing for possible winter blackouts.

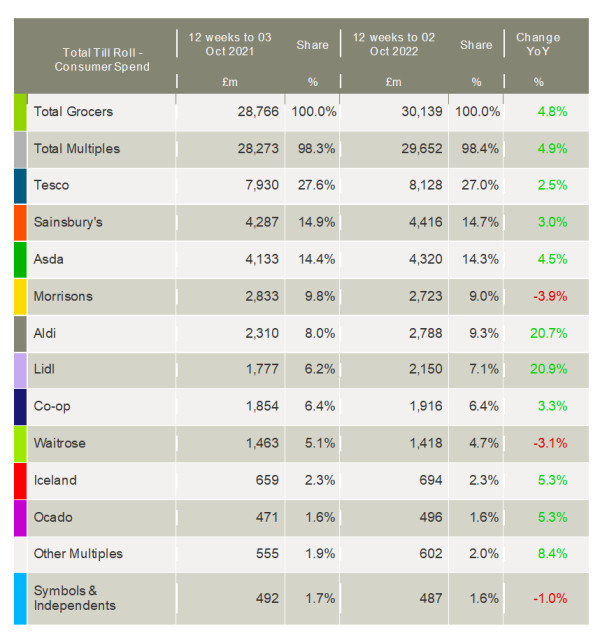

For the fifth month in a row, Lidl was the fastest-growing grocer this period, with its sales up by 20.9% over the 12 weeks, marginally ahead of Aldi whose sales rose by 20.7%. Lidl’s share of the market is now 7.1%, up from 6.2% last year, while Aldi moved to 9.3% from 8.0%.

Asda led the way among the traditional major supermarkets, with its sales growing by 4.5% as recent value initiatives helped attract 417,000 new customers through its doors compared with last year. Kantar noted that the retailer’s new ‘Just Essentials’ offer continued to drive growth, with nearly two-thirds of Asda’s 15.2 million shoppers picking up at least one item from the range.

Sales at Sainsbury’s rose by 3.0% and 2.5% at Tesco, whilst Morrisons continued its poor run with sales falling 3.9%. Both Iceland and Ocado grew by 5.3%, slightly ahead of the market to maintain their market shares at 2.3% and 1.6%, respectively. Co-op also held market share flat year-on-year at 6.4%, with its sales growing by 3.3%. Waitrose’s market share slipped to 4.7% as it continued to lose sales amidst the shift to value-orientated supermarkets.

NAM Implications:

- A real-world indicator of the UK’s upcoming Winter of Discontent?

- ‘The average household is facing a £643 jump in their annual grocery bill to £5,265 if they continue to buy the same items’.

- This has to drive consumers further into ‘shopping around’ for value at the expense of Waitrose (down 3.1%).

- i.e. Discounters and own-label

- Anyone still in doubt need only compare Aldi/Lidl growth rates of 21% vs Mults 4.9%.

- (with a combined share of 16.4% vs Tesco 27% makes discounters No.2…)

- Own-label sales up 8.1% vs. brands down 0.7% says it all for own-label…

- If these changes represent structural changes in UK retail…

- i.e. long term…

- Time for suppliers to have a fundamental rethink re the role of discounters and own-label in trade strategies?