The latest take-home grocery figures from Kantar show sales fell by 0.4% during the 12 weeks to 16 May as normal shopping behaviour started to return amid people socialising and eating out more.

The year-on-year decline also reflects a tough comparison with exceptionally high sales during the first three months of the pandemic last year. However, sales remain stronger than they were before the crisis and shoppers spent an additional £3.8bn in supermarkets during the past three months compared with the same period in 2019.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Many of us this time last year were eating all our meals at home and we bought extra food and drink as a result. Now we’re seeing take-home grocery sales dip versus 2020 as people are able to eat in restaurants, pubs and cafés and can pick up food on the go again, grabbing a sandwich, for example, while they’re out and about at the weekend.

“While not captured in these take-home figures, on-the-go grocery sales look set to be a significant driver of growth for supermarkets over the next few months.”

Kantar highlighted that the vaccine rollout has made people more confident about venturing back out to stores. Shoppers made 58 million more visits to the supermarket this period than they did in May 2020.

There are also signs that the big weekly shop, which made a comeback last year while people tried to reduce time spent outside of home, may be on its way out. Basket sizes have fallen for three months in a row and the average price of a trip to the grocery store over the month to 16 May was £22.82, the lowest since March last year.

The proportion of supermarket sales made online – another hallmark of shopping habits last year – remained much higher than 2019 levels but fell back from 13.9% in April to 13.4% in the latest month. Convenience stores, both independents and smaller formats of the major chains, are also seeing some of their market share gains unwind too. Collectively these smaller stores now account for 12.5% of sales, down from 14.9% in May 2020.

Meanwhile, a return to socialising means that people’s lives are becoming busier again and convenience is rising back up the agenda. McKevitt said: “Efforts to make meal times easier are reflected in a rise in sales of chilled ready meals by 20%, cooked poultry by 28% and sandwich fillings by 12%. Ditching the sofa and emerging from our homes also saw people prioritise their personal appearance. As a result, sales of mouthwash grew by 16%, hair styling products by 26% and shoe care products like polish by 50%.”

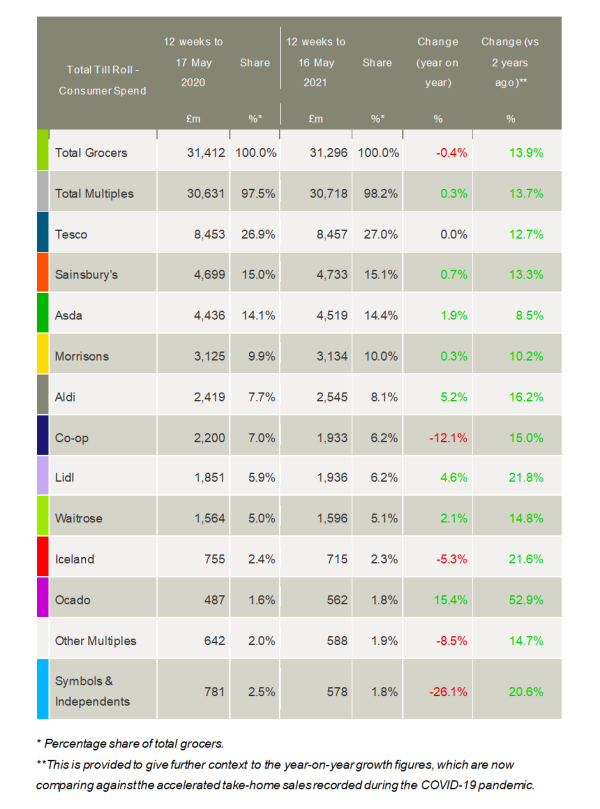

Both Aldi and Lidl grew ahead of the market this period and gained market share with take-home sales up by 5.2% and 4.6% respectively. Sales at the discounters had been impacted by shoppers favouring online and cutting back on the number of stores they visited, but the tide appears to have turned this period. Aldi’s share increased by 0.4 percentage points to 8.1% and Lidl’s by 0.3 percentage points to 6.2%.

All four of the largest supermarkets gained market share. After lagging behind its rivals over the last year, Asda was the biggest winner this period, with sales up by 1.9% and share increasing from 14.1% to 14.4%.

Sainsbury’s grew sales by 0.7% while Morrisons was up by 0.3%. Tesco’s sales remained flat versus last year but all three retailers secured an additional 0.1 percentage point of market share. Waitrose also won share, up to 5.1% from 5.0% last year, with sales increasing by 2.1%.

Ocado was the fastest-growing retailer, gaining 0.2 percentage points of share this period. However, its sales slowed substantially year-on-year to 15.4% as it faced tough comparatives with a bumper period in 2020.

Sales in symbols, independent retailers and the Co-op were down in comparison with last year when consumers flocked to their local store to buy groceries. However, they remained in double-digit growth against the more typical sales of 2019. Convenience stores also benefited from the return of on-the-go food and drink sales – representing additional growth that is not captured in Kantar’s take-home figures.

Meanwhile, grocery inflation continued to fall and now stands at -1.2%. Prices rose fastest in markets such as chocolate confectionery, savoury snacks and canned colas, while falling in fresh bacon, toilet tissue and vegetables. McKevitt commented: “The good news for households wanting to keep on top of their grocery spending is that like-for-like prices are lower than last year when fewer products were bought on promotion. This is the fastest fall in prices since August 2016, a trend we expect to normalise as the year progresses.”

NAM Implications:

- Hopefully, the impact of social distancing sales resistors being diluted…

- Key to optimise these Kantar stats by comparing your sales by retailer and channel…

- …and by category, where possible.

- Also good to explore the impact on financial indicators of your major customers…

- …and identify your demonstrable value in terms of financial impact on their business.