Lidl remained the fastest growing retailer in the UK over the 12 weeks ending 10 September, as food inflation accelerated and shoppers focused on buying little and more often to help manage rising grocery bills. The NielsenIQ data also shows Asda is bouncing back as it benefits from recent value initiatives.

Total Till sales growth slowed from 4.5% the previous month to 2.5% in the last four weeks of the period as shoppers returned from holidays, returned to work and reset their spending patterns after the summer.

The NielsenIQ research also found that sales at the supermarket multiples during the week ending 10 September dipped to £2.48bn, which is the lowest level this year since the lull in the week after Easter 2022. To put this into context, for the four week period this is £400m less being spent at supermarkets as shoppers rein in spend at the start of autumn.

Moreover, with the cost of household bills surging, volumes are down 4.4% at the grocery retailer over the last 12 weeks.

Promotional spend also continues to flatline, accounting for only 20.9% of all sales.

NielsenIQ noted that visits to stores increased by 4.8% in the last four weeks, while online visits declined by 5.3%. This equates to 1 million fewer online deliveries than this time last year. As a result, online sales fell 7% compared with the same period last year.

The online share of FMCG sales has now declined to 11.1% – down from 11.3% last month and down from 12.3% a year ago. NielsenIQ suggested that the decrease may indicate that this is now approaching the normal level for online share.

By category, pet & petcare was the fastest growing over the four weeks with value growth of 12.7%. Meanwhile, there was also strong value growth in soft drinks (+11.0%). This category was also the only FMCG category to see volume growth (+4.5%). However, food inflation continues to lift value growth in dairy (+9.3%) and bakery products (+6.9%). There were value sales declines across beers, wines and spirits (-4.5%), fresh produce (-2.3%), and confectionery (-2.0%).

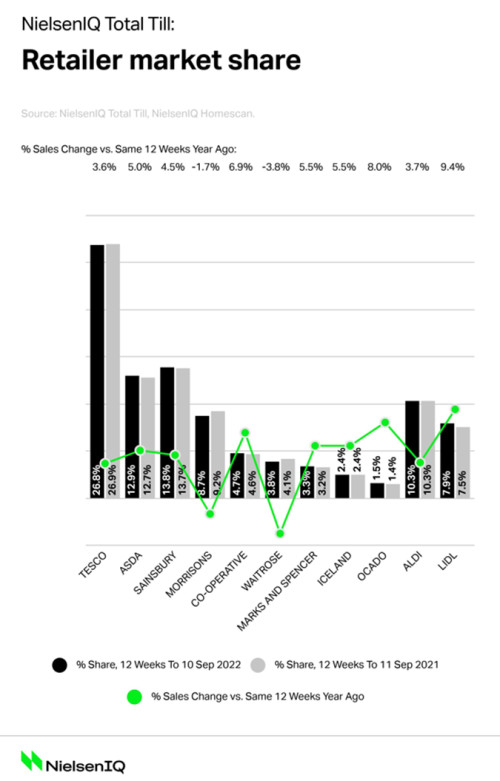

In terms of retailer performance, Lidl (+9.4%) remained the fastest growing grocery retailer over the last 12 weeks, closely followed by the Co-op (+6.9%), Marks & Spencer (5.5%) and Iceland (5.5%).

Asda (5.0%) was the fastest growing retailer amongst the Big Four supermarkets, while sales at Morrisons and Waitrose continued to fall.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, commented: “Asda’s sales have rebounded strongly in recent weeks, helped by weak year-ago sales, but the retailer has also been attracting new shoppers. This suggests that new range initiatives such as Just Essentials and the roll out of Asda Rewards are giving a stronger price perception and now starting to have an impact on sales.”

He added: “With food prices continuing to rise and household energy costs about to jump in October, it’s no surprise that our data shows that 57% of consumers are saying they have been severely or moderately affected by the cost of living crisis, and in three months this is anticipated to rise to 76%. With CPI inflation expected to remain close to current levels for the rest of the year, this will encourage households to shop around and to look for savings across different retailers, with shoppers increasingly focussing on the cost of their weekly groceries to help manage personal finances.”

NAM Implications:

- Asda was always going to gain from current economic pressures on the consumer.

- Only issue will be the increasing cost of debt causing distractions for Asda…

- Patently, food price inflation will continue to cause changes in these stats…

- …especially as we reach limits of consumer tolerance of on-shelf price rises.

- Meanwhile, the extent of the discounter threat is obvious from the chart.