Latest data from Kantar shows take-home grocery sales in Ireland increased by 6.1% in the four weeks to 29th September. As families got ready for the return to school after the summer break, sales volume increased by 3.6%, with people shopping more frequently (+1.5%).

Meanwhile, grocery inflation stood at 2.67%, representing a slight decrease of 0.09 percentage points from the previous period.

As households settled into their autumn and back-to-school routines of preparing school lunches and dinners, they spent an additional €2.6m on fresh vegetables and €1.9m on fresh fruit. Shoppers also stocked up on pantry staples, spending an additional €1.4m on ambient bakery breads, nearly €1m more on frozen goods, and €1.5m more on soft drink carbonates.

Eimear Faughnan, Kantar’s Worldpanel Head of Retail, commented: “As shoppers returned to their back-to-school routines, they continued to purchase family-favourite brands. Brand sales grew by 8% compared to last year, outperforming own-label products once again this period, increasing their value share of total spending to 48.2%.”

Even with branded products growing every month, own-label ranges also saw their value sales increase by 3.9% this month compared to last year. Most of this growth came from standard private-label products, which added an extra €50m in value to the own-label range. Kantar noted that while premium own label represents a smaller portion of retailer offerings, it contributed an additional €9.2m compared to last year.

Online sales increased by 9.6% year-on-year, with shoppers spending an additional €17m through this channel. Retailers are driving this growth by offering online incentives, including money off vouchers and free delivery in some cases, which have encouraged shoppers to return more frequently. The latest 12-week data shows that this increase in platform visits was the main contributor to the growth, rising by 12.3%.

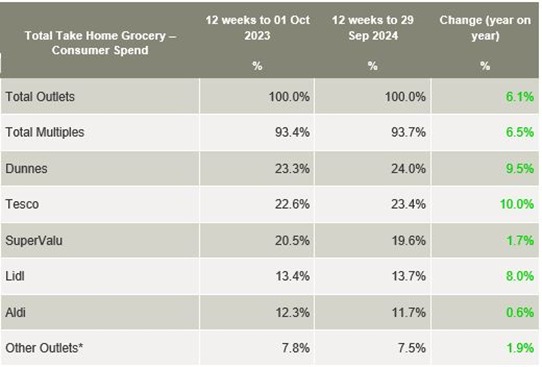

Dunnes held a 24% market share during the period and saw value growth of 9.5% year-on-year. It had the strongest frequency growth among all retailers, at 9.3% year-on-year, which contributed an additional €67m to its overall performance.

Tesco controlled 23.4% of the market, with value up 10%. This growth mainly came from recruiting new shoppers, alongside existing shoppers making more frequent and larger trips, which contributed an additional €47.5m to its overall performance.

SuperValu’s share stood at 19.6% after growth of 1.7%. Its shoppers made more trips in-store than those of any other retailer – an average of 24 trips – which contributed an additional €13m to its overall performance.

Lidl held a 13.7% share after growth of 8%. It continued to recruit new shoppers, contributing an additional €12m to its overall performance. Meanwhile, Aldi’s share slipped again to 11.7% after growth of just 0.6%. More frequent trips contributed an additional €18m to its overall performance.

NAM Implications:

- A recurring stand-out has to be the combined discounter share of 25.4%…

- …vs market leader Dunnes at 24%.

- Ireland has always been a traditionally brand-loyal market…

- …with consumers possibly willing to ‘tolerate‘ larger brand premia than other countries.

- Meanwhile, online sales growth being driven by (money off) promos and free deliveries in some cases…

- …will impact retailers’ bottom lines.