Latest Kantar data shows that take-home grocery sales in Ireland increased by 5.4% in the four weeks to 1 September as families prepared for the new school year, with volumes per trip edging up 0.4% after six months of decline.

Despite inflation rising again and sitting at 2.8% over the full 12-week period, it is still the lowest inflation level since March 2022 and is down 8.5 percentage points from September 2023.

Emer Healy, Business Development Director at Kantar, commented: “As summer comes to an end, many shoppers prepared for the back-to-school routine, with more packed lunches and after-school meals to prepare. Shoppers continue to take advantage of promotional offers from retailers with spending on promotions up 9.6% compared to this time last year.”

Irish shoppers continued to be drawn to retailer’s own-label ranges, with sales up 4.5% year-on-year. Own-label held its value share of the market at 47%, with shoppers spending an additional €66.8m on these ranges compared to the same period last year.

Premium ranges also continued to do well, with shoppers spending an additional €14.2m on these lines, up 10.2%. However, with retailers heavily promoting brands in their recent advertising campaigns, branded goods outpaced total market growth, increasing by 8.4%, with shoppers spending an additional €121m compared to last year. Over 60% of branded products were purchased on some form of promotion, a 9.8% rise from the same period last year.

Meanwhile, online sales were up 10.7% as shoppers spent an extra €18.2m year-on-year. A boost in the frequency of online trips contributed a combined additional €17.5m to the channel.

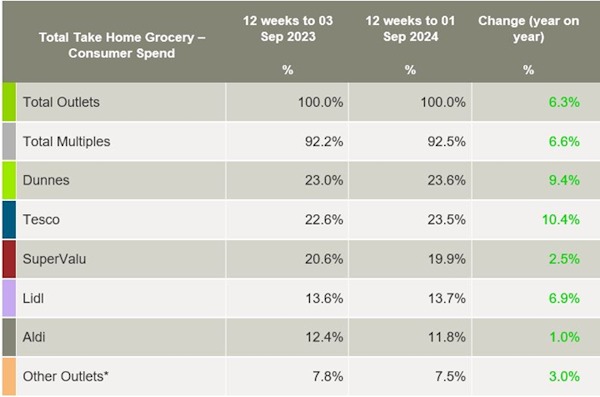

Looking at retailer performances, Dunnes controlled 23.6% of the market after seeing growth of 9.4% year-on-year. It had the strongest growth in trips amongst all retailers, up 12% and contributing an additional €83.6m to its overall performance.

Tesco’s market share rose to 23.5%, with spending up 10.4%. Its growth stems mainly from more frequent trips, which contributed an additional €32.9m to overall performance.

SuperValu held 19.9% of the market with growth of 2.5%. Its shoppers made the most trips in-store when compared to all retailers, 21.8 trips on average, up 2.5% year-on-year, which contributed an additional €15.5m to its overall performance.

Lidl’s share was 13.7% after seeing growth of 6.9%. More frequent trips in-store, alongside new shopper recruits, contributed an additional combined €27m to the discounter’s overall performance.

Meanwhile, Aldi’s market share fell again to 11.8% after seeing growth of just 1%. More frequent trips contributed an additional €9.4m to its overall performance.

NAM Implications:

- A standout item has to be the continuing switching to own label, currently 47% of sales in a traditionally brand loyal market…

- …with brands knowing how difficult it can be to win back loyals that have tried an own-label equivalent and found it ‘better than expected’.

- However, because suppliers heavily promoted brands…

- …branded goods outpaced total market growth.

- Meanwhile, Lidl & Aldi produced a combined share of 25.5%…

- …despite Aldi continuing to lose share.

- A development that will not go unnoticed by UK Aldi-watchers…