Latest NIQ data suggests that an improvement in the summer weather in early September helped boost demand in UK supermarkets, with total till sales growing 10.3% year-on-year during the four weeks ending 9 September, up from 7.2% during the wet July and early August.

Performance peaked in the final week of the period when the UK experienced a heatwave. Volume sales during these seven days were up 2.1% – the first volume increase since the first week of May 2023. Volume sales over the full month edged down 0.7%, but this was better than the 3.8% fall last month.

As temperatures rose, consumers visited stores and purchased more fresh food items. A total of £172m was spent on fresh poultry (value sales +13% and volumes +5%) in the four week period, with chicken thighs and drumsticks (+28% value sales, volumes +15%) proving popular.

Sales also grew for fresh produce (value growth of +11.8% with volumes +2.1%), which included seasonal foods such as tomatoes (volumes +1.5%) and lettuce (volumes +3.9%). The end of summer clearances and back-to-school promotions also led to an uplift in volume sales of general merchandise items (+1.7%).

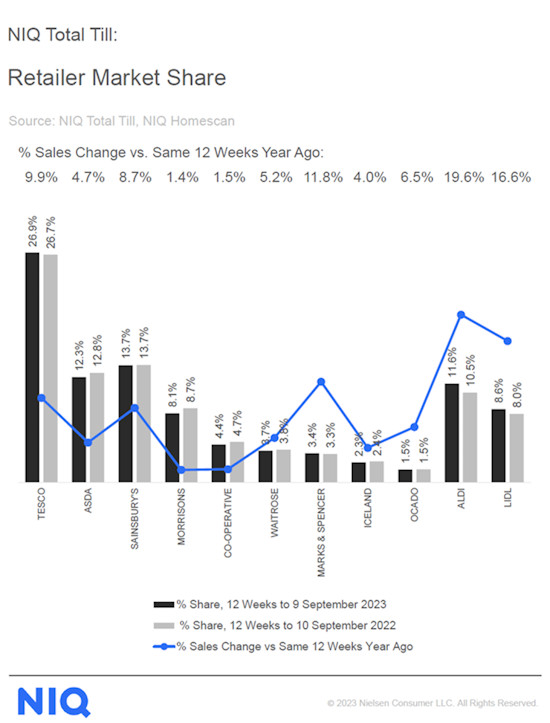

Over the full 12-week period, NIQ’s data shows total till sales grew 8.9%. In terms of retailer performance, nearly 1 in 3 households shopped at M&S – almost the same as Co-op – with strong sales growth (+11.8%) helped by the opening of new Foodhalls across the country.

Tesco (+9.9%) also gained market share, whilst Sainsbury’s (+8.7%) share held firm. Both retailers used price cuts delivered through Clubcard and Nectar loyalty schemes to drive top-line growth as inflation started to slow.

NIQ noted that this is in tune with current shopper needs, with data from its recent Consumer Outlook Mid-year report showing that the most important saving strategies at the moment are shopping at stores with loyalty discounts and opting for own-label.

However, Aldi (+19.6%) and Lidl (+16.6%) continued outperforming across all shopper metrics with new shoppers, more visits and higher spend per visit contributing to their combined market share of 20.2%.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commented: “There are some improvements showing in shopper sentiment as inflation continues to slow, and there is now a growth in real incomes.

“Retailers are keen to pass on price cuts as inflation continues to slow. However, they also need to make sure that messages resonate with price-conscious consumers, as for some, their discretionary spending power is still limited. We know there is a polarisation of purchasing power, with 44% of households impacted only a little or not at all by increased cost of living, yet 56% of households are moderately or severely affected, leaving them budgeting carefully.

“The good news is that FMCG volumes are starting to improve against the declines of last year so we expect Total Till growth to be around 7% in Q4 and volume growth at food retailers in December.”

NAM Implications:

- Over the medium term, volume sales are still falling…

- Bearing in mind that slowing inflation simply means that prices are rising more slowly…

- (if in doubt, simply ask the cash-strapped shopper)

- And discounter growth still points at the need for branded suppliers to be on board.