Latest market data from Nielsen shows grocery sales slowed to their lowest September growth for two years with retailers urged to bolster promotional activity to tempt cautious shoppers to start spending ahead of the all-important Christmas trading period.

Overall grocery sales growth slowed to 1.7% in the four week period despite sunny weather in the first weeks of September boosting sales in soft drinks (+2.7%), crisps and snacks (+2.3%) and frozen foods (+2.1%). However, general merchandise sales fell by 4.7%, suggesting a weakness in discretionary non-food spend.

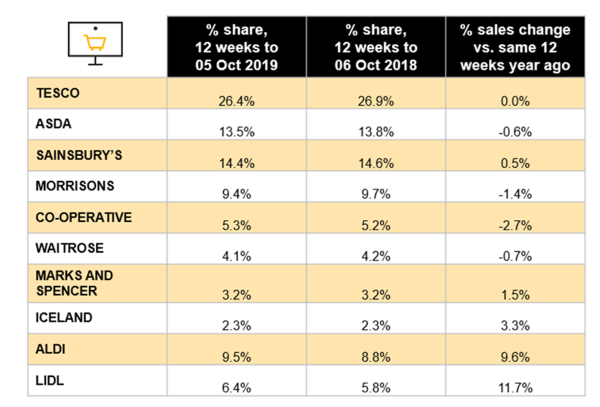

In terms of retailer performance over the last 12 weeks, Nielsen’s data shows sales at Tesco and Sainsbury’s remained broadly flat, whilst Asda and Morrisons experienced a slight decline. Sales at Aldi and Lidl continued to grow but at a slower rate than earlier this year.

With the slowdown in recent weeks, Nielsen suggested that supermarkets will need to increase advertising and promotion efforts to encourage consumers back into shops ahead of the ‘golden quarter’ of seasonal shopping around Christmas and New Year.

Data from Nielsen AdIntel reveals that in the first eight months of the year, Aldi ranked as the top supermarket advertising spender, increasing spend by over 9% to £25.7m. Sainsbury’s has more than doubled spend so far in its anniversary year to £11m. However, advertising spend overall by UK supermarkets has declined by 1%.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “With volume sales still in decline at -0.6% in major UK supermarkets, it’s clear that shoppers are continuing to hold back spend. Against a backdrop of simmering economic uncertainties and the looming deadline of Brexit, as well as the UK having its lowest food inflation rate since April 2018, retailers are finding it more of a challenge to drive topline sales.”

He added: “Though many retailers are starting to introduce price cuts to help regain momentum after the unpredictable summer, it is evident that retailers will need to invest more heavily in promotional and advertising activity if they want to have the best chance of success in the run up to the seasonal shopping period. This should help lift consumer buying momentum and kick start Christmas and seasonal shopping.”

12-weekly % share of grocery market spend by retailer and value sales % change