Grocery spending in UK convenience stores grew by 3.3% over the four weeks to 11 September, outperforming growth in supermarkets, which rose by 0.6% during the same period.

This is according to new data released by NielsenIQ, which suggested that the shift towards the convenience channel is the result of a gradual return of pre-pandemic consumer habits. This comes as workers start to return to offices, children are back in schools, and there is less of a need to plan ahead for a big shop, with consumers looking to shop more locally, impulsively and ‘little and more often’.

The NielsenIQ data shows visits to all stores were up 10% compared with last year. However, visits were down 6% compared to 2019, showing there is still headroom for growth at stores. The online share of sales remained steady at 12.4%, slightly down compared with the same period (13%) last year with the trend towards smaller online baskets.

Despite the current economic and supply chain turmoil, NielsenIQ’s figures show total till grocery sales for the four weeks to 11 September rose 1.8% compared to the same period last year. This was an improvement from 1.1% in August and a 7.3% growth in sales against 2019.

Shoppers spent £9.8bn at the main supermarkets during the latest four weeks, which is £526m more than the same period in 2019 (+6%), indicating robust food retail spend for the end of the third quarter despite the hospitality industry reopening.

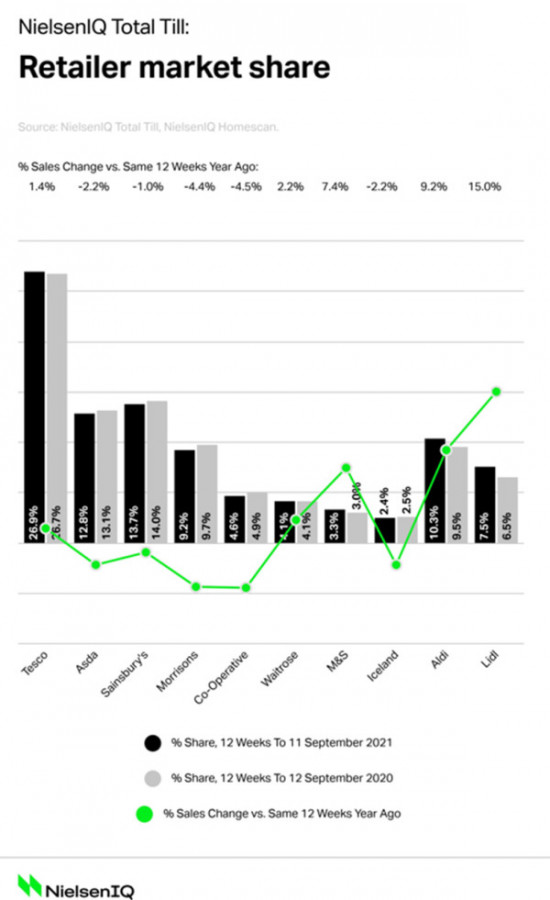

As another indication that consumers are returning to old habits, ‘shopping around’ trends are returning with all supermarkets experiencing a jump in new shoppers over the last 12 weeks ending 11 September. Tesco (sales +1.4%) continued to gain overall market share (26.9% compared to 26.7% a year ago). M&S (+7.4%) also experienced strong growth in sales, whilst Aldi (+9.2%) continued to improve with Lidl (+15%) still the fastest-growing retailer.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, commented: “UK shopping habits are shifting once again, this time towards convenience channels as Brits return to more impulsive shopping behaviours that correspond with a return to pre-pandemic lifestyles. The warm weather in early September also helped.

“There remain some clouds on the horizon as rising energy costs and inflation could hit disposable incomes, whilst availability concerns could present challenges. However, grocers can still expect to look forward to a short-term boost as some of the incremental spend has not yet returned to the hospitality channels, and shoppers are likely to plan in advance if household budgets are more constrained.”

He concluded: “For retailers and manufacturers, there are three challenges as we look ahead to the golden quarter. The first is to encourage bigger spends on every shopping trip now that habits are shifting away from a big shop online and towards new, and smaller missions at stores. The second is having inspiring media campaigns in October that help to build spend for the festive period and for the big Christmas shop. Finally, grocers must prepare for the tightening of budgets later in the year which means ranges and pricing must reflect this in order to resonate with price-conscious consumers.”

12-weekly % share of grocery market spend by retailer

and value sales % change

NAM Implications:

- Smaller, more often, meaning meal-specific shopping i.e. less waste

- Therefore local convenience is a place to be…

- …and requiring ‘hand-in-glove relationships with wholesalers to optimise the channel.

- A no-brainer?