New data released by NielsenIQ (NIQ) shows total till sales growth at UK supermarkets remained unchanged at 4.1% over the four weeks to 4th October, driven by food inflation after a 0.5% fall in volumes.

The research group noted that this reflects shoppers’ caution amid ongoing economic pressures, as many look to deals to offset household costs following the back-to-school period and summer spending. With this in mind, in-store visits rose 3.5% as shoppers sought the best promotions, which accounted for 23% of supermarket sales over the four-week period. NIQ suggested that the trend in the next four weeks will be more indicative of shoppers’ willingness to spend, given the recent spell of weak consumer confidence.

Meanwhile, the data confirms that households are trying to be healthier, with 54% saying that avoiding ultra-processed foods is very important to them and 52% cooking more meals from scratch. This is reflected in category performance, which shows that the fastest-growing supercategory in unit sales (+0.7%) was meat, fish and poultry, with value sales also up (+5.9%).

In contrast, sales for beer, wine and spirits were weakest of any supercategory, with unit sales declining 2.6% and value sales down 0.6%. That being said, no/low alcoholic beer now accounts for 3.9% of beer sales (£219m) for the latest year and is growing by 4.5% in unit sales and 12.1% in value in the latest 4 weeks, highlighting peoples’ desire to moderate their drinking.

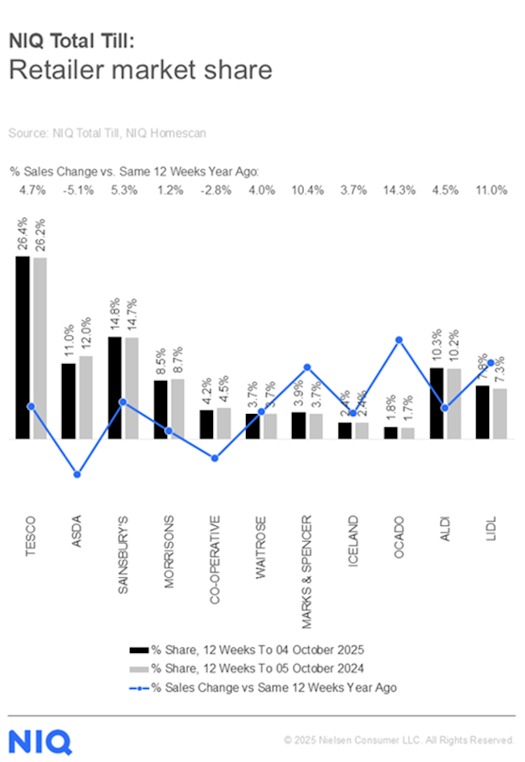

In terms of retailer performance, Ocado (+14.3%) remained the fastest growing retailer, while Lidl (+11%) continued to grow at a strong pace. Marks & Spencer also performed well, with sales growing 10.4%.

Sainsbury’s (+5.3%) and Tesco (+4.7%) maintained their market share gains, boosted by loyalty card prices, which are driving more customer visits. Meanwhile, sales at Asda slid 5.1%, with its performance impacted by an extension of its RollBack campaign, driving down average spend per visit. Co-op was the only retailer with fewer customer visits last month, leading to its sales falling 2.8%.

“It looks like many households have pressed the reset button after the summer,” said Mike Watkins, Head of Retailer and Business Insight at NIQ.

“Shoppers are buying less with unit sales across the total store down 0.5% and value growth remains below food inflation. So, any further increase in inflation would add pressure to discretionary spending this side of Christmas. However, many retailers are introducing targeted price cuts to regain momentum after a strong summer, so shoppers should start to see a benefit in their shopping baskets.”

He added: “There are three emerging trends that could also influence what shoppers put in their shopping basket this Christmas: moderation in alcoholic beverages, seeking out healthier food options and cooking from scratch and for those households where weight loss medication is being used, a small (-5%) reduction in the value of the grocery spend. The battle for shopper wallets going forward will not only be won on price but on range, quality and increasingly, offering lifestyle choices.”

NAM Implications:

- The message no one wants to hear…

- But realists have to find ways of moving forward.

- As markets tighten, any growth comes at the expense of rivals.

- Meaning a realistic assessment of relative competitive appeal is vital.

- With opportunities available for those who are prepared to act…

- ..while rivals await a return to ‘normal’.

- Meanwhile, suppliers will need very good reasons for investing in Asda, Morrisons and Co-op…

- …at the expense of more certain returns from those retailers growing market share.