Latest data from Kantar shows take-home grocery sales in Ireland increased in the four weeks to 19 March thanks to a month of celebrations, including Mother’s Day, St Patricks Day and the Irish rugby team winning the Six Nations Grand Slam.

The value of grocery sales increased by 13.3%, up from 10.2% in February, as the average price per pack increased by 13.8%.

Emer Healy, Senior Retail Analyst at Kantar, commented: “March was a busy month for Irish consumers with plenty of events and opportunities to celebrate. We also welcomed longer, brighter days so we saw shoppers visiting stores more often. Shopper visits grew 13% year-on-year, which is the highest level of footfall since March 2020. In actual terms, this means shoppers made two additional trips to stores in March.”

Grocery inflation in Ireland was up by 16.8% when compared to the same 12-week period last year – the highest level ever recorded by Kantar.

“Although value sales are up significantly, grocery price inflation is still the driving factor rather than just increased spending,” said Healy. She noted that the annual grocery bill for Irish consumers is set to rise by €1,211 if they don’t make changes to their shopping habits.

In the 12 weeks to 19 March, take-home grocery sales increased by 9.5%, contributing an additional €268m to the overall market performance, as shoppers returned to store more often (up 7.7%) and average price per pack increased by 13.9% year-on-year.

“Consumers are opting to shop little and often to help manage their household budgets. Basket mission really drives growth for the overall market – up 25.1% – with shoppers spending an additional €119.6m year-on-year. The indulgent mission grew 17.7% year-on-year, as shoppers made more indulgent trips in line with the festivities in March,” commented Healy.

Meanwhile, the Irish market continues to see much stronger own-label growth (+13.5%) than brands (+6.2%) as shoppers look for ways to save money. Value own-label saw the strongest growth (+34.5%) year-on-year, with shoppers spending €18m more on these ranges. Own-label now holds a higher value share than brands – 47.3% compared to 47%.

Online sales also remained strong over the 12-week period, up 2.6%, with shoppers spending an additional €3.9m online year-on-year. More frequent trips (4%) and higher average prices (15.5%) helped to drive growth.

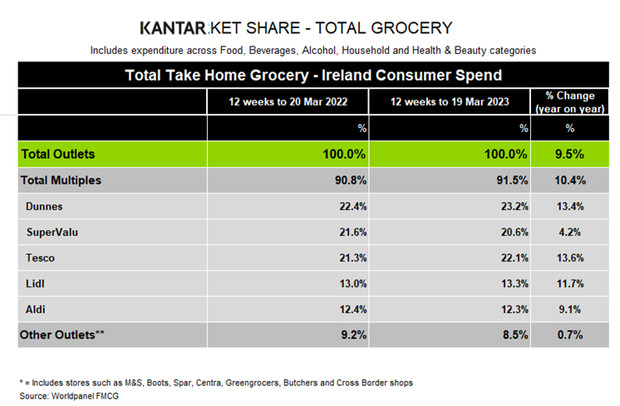

Each of the major retailers continued to see positive results, with sales growth accelerating from February to March.

Dunnes held the highest share amongst all retailers at 23.2%, with growth of 13.4% year-on-year. This growth stems from an influx of new shoppers to its store, up 1.3 percentage points, and shoppers returning more often to store, up 4.7%. Tesco controlled 22.1% of the market with growth of 13.6% and the strongest frequency growth amongst all retailers, up 12.8%.

SuperValu held 20.6% of the market and saw growth of 4.2%, with shoppers making the most trips in store when compared to all retailers, with an average of 21.7 trips over the 12-week period, an increase of 12.1% year-on-year.

Lidl’s share rose to 13.3% after seeing growth of 11.7%. An influx of new shoppers and more frequent trips contributed an additional €25.2m to its overall performance. Aldi held 12.3% share with growth of 9.1% after new shoppers and more frequent trips contributed an additional €40.1m to its overall performance.