Data from Nielsen confirms that UK supermarkets have experienced a slow start to the festive period with all the big four chains losing further market share. Overall grocery sales continued to weaken for the second consecutive month, slowing to just 1.1% growth in the last four weeks.

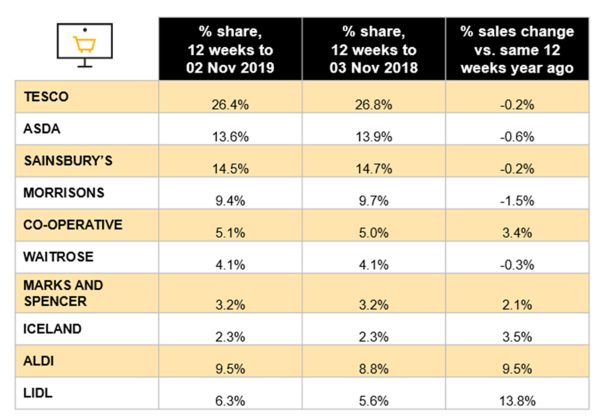

While grocery sales increased by almost £500m in the last 12 weeks, Nielsen found that Tesco, Sainsbury’s, Asda and Morrisons had all experienced a decline in sales. Their combined market share fell to just below 64%, compared with 67% this time three years ago.

As a result, almost 73% of incremental sales in the last 12 weeks were made at discounters Aldi and Lidl. Sales at M&S continued to improve, up 2.1%. Iceland grew by 3.5%, whilst growth at the Co-op remained strong at 3.4%.

Despite the slow start, Nielsen is predicting that grocery spending will rebound in the next four weeks, as the roll out of retailers’ high-profile Christmas advertising campaigns kick starts festive shopping. The research group highlighted that the digital roll-out of Sainsbury’s Nectar loyalty scheme and launch of Tesco’s new Clubcard Plus offer could help both chains regain sales during this crucial shopping period.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, commented: “The in store promotional activity ahead of the festive period, from Halloween to retailers’ money off vouchers, clearly proved less effective with consumers as grocery sales largely fell flat in the last four weeks at the big four supermarkets.

“Whilst the economy remains Brits’ number one concern, rising food prices and global warming are climbing up the agenda, and are all motivating shoppers to spend differently. Moreover, with the continued uncertainty around Brexit and now a general election on the horizon, shoppers are increasingly adopting a savings mindset.”

He added: “What’s more, over half of UK shoppers now prefer to save any spare cash rather than spend it, and are also switching spend to the discounters and high street value retail chains. This has caused a relatively slow uptake to the promotions in the last few weeks, but we can expect the shopping momentum to pick up as the seasonal period draws closer and shoppers embrace the festive spirit.”

12-weekly % share of grocery market spend by retailer and value sales % change