New figures from Nielsen show sales at convenience stores in the UK grew by almost a fifth (17%) in the four week period ending 13 June, as consumers continued to prioritise shopping at their local stores during the coronavirus crisis.

Demand for convenience shopping outpaced overall total till sales in the grocery market (14%) during the same period – with 25% of shoppers claiming to have shopped more at their closest store than they did pre-Covid. Within this small store format, sales at independent shops and symbol retailers grew by an average of 33% over the four weeks.

In contrast, despite this increase in convenience store shopping, Nielsen’s data shows that overall sales at bricks & mortar grocery retailers grew by only 6%, whereas online sales grew 115% compared to the same period last year, maintaining the online share of sales at 13% in the last four weeks. The average spend per shopping visit across all formats was £20.32, a decrease of £1.30 compared to the previous month.

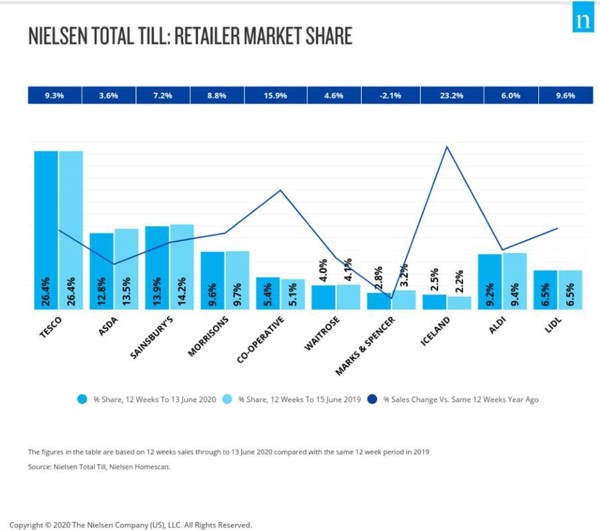

Over the last 12 weeks, Iceland (+23%) continued to outperform all other major grocery retailers in the UK, following strong growth in its Food Warehouse stores in retail parks. The retailer has also benefitted from the surge in demand for frozen foods, which grew by 32% across the industry in the four week period.

Moreover, sales at the Co-op (+16%) also grew faster than the Big 4 supermarkets as shoppers continued to do a larger shop at convenience stores.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, commented: “After three months of lockdown, UK shoppers have clearly adapted to their new shopping routines and in the last four weeks have shopped in the same way as they did in April and May – fewer visits but bigger trolleys and bigger basket spend. Whilst the dramatic shift to online has been significant, we expect this share of sales to be maintained over the next few months. However, what is just as important is how shoppers have now embraced ‘ultra local’ stores during this time.”

Watkins added: “Looking ahead, as households slowly ‘de stock’ and as pubs and restaurants are expected to progressively (but slowly) re-open, we still anticipate that the average level for total till grocery sales will grow between +5% and +10% over the next couple of months, and staycations could help to give a further boost to grocery sales.”

12-weekly % share of grocery market spend by retailer

and value sales % change

NAM Implications:

- There should be no surprises here.

- Key issue is how your convenience business compared…

- …and the need to ensure that your company is taking online sufficiently seriously.

- (we mean online growth of 115%!! compared to the same period last year).