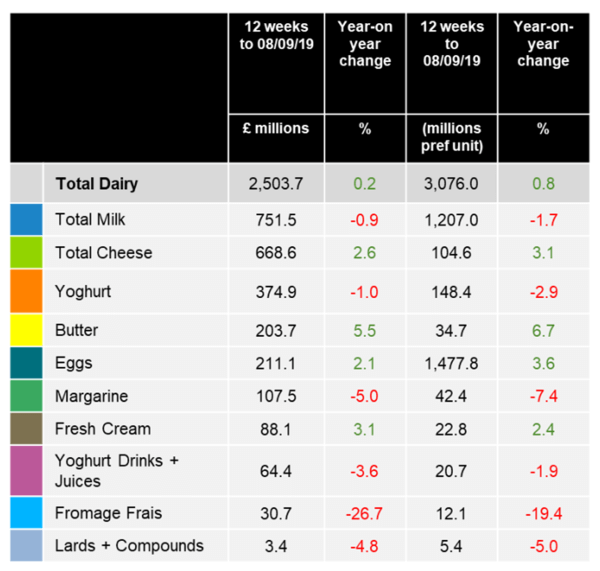

Latest data from Kantar, covering the 12 weeks to 8 September, shows the performance of the dairy market continuing to weaken, growing just 0.2%, compared to 0.7% in the previous 12 week period.

The overall grocery market grew 0.5% over the same period, improving on a flat performance, with the fresh and chilled sector’s performance also heading in the right direction (up 0.5%).

Commenting on the findings, Oliver Bluring, Category Manager at Kantar, said: “Almost all dairy sectors have contributed to the market’s worsening performance, with cheese and cream the only bright spots. Margarine fares the worst, with the decline of the category deepening by £4.7m.”

Most retailers also make a lesser contribution to the market’s overall performance, with only Waitrose, Ocado and M&S seeing improvement. Tesco and Aldi in particular saw their contributions to growth worsen by £4.5m and £3m respectively. In margarine, the decline was fairly widespread, although Tesco suffered the worst, with the retailer’s sales falling by a further £1.7m compared with last month.

Bluring added: “There is a reversal of fortunes among more affluent Class ABC1 shoppers, who last period saw an increase in their growth but now see this fall off by £10.4m. All life stages – aside from older dependents – also see a step down in their performance, with spend from retired shoppers falling fastest. All demographics are spending less on margarine, again with the biggest drop offs among ABC1 and retired shoppers.”

In terms of promotions, there was improved performance from sales on temporary price reduction (+£9.5m), although this was more than offset by a weaker performance from Y for £X deals (-£10.1m) and full price sales (-£12.5m). For margarine, declines were evident across promoted and non-promoted sales, although the biggest losses were among full prices sales which declined by a further £3.5m.