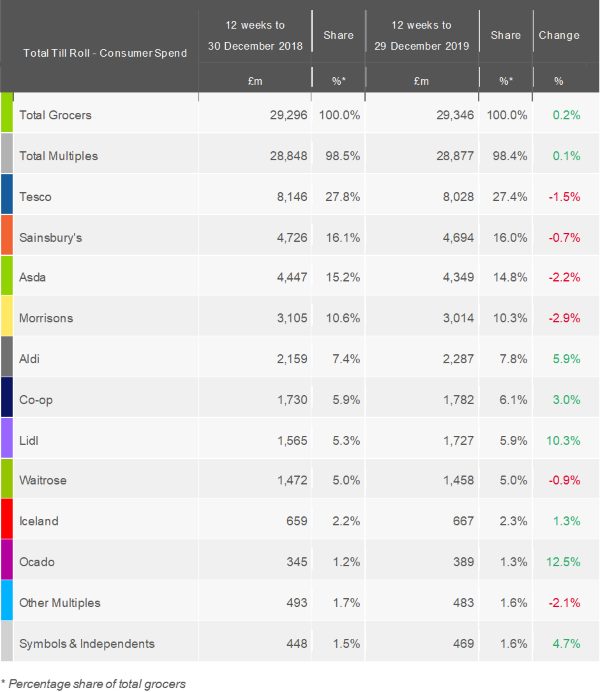

Latest grocery market share figures from Kantar show year-on-year supermarket sales grew just 0.2% in the 12 weeks to 29 December, with the Big Four chains all seeing declines as Aldi and Lidl continued to attract shoppers over a subdued Christmas trading season.

While retailers still took a record £29.3bn through tills in the so-called golden quarter – up £50m on last year – 2019 saw the slowest rate of growth over the Christmas period since 2015.

Fraser McKevitt, head of retail and consumer insight at Kantar commented: “There was no sign of the post-election rush many had hoped for in the final weeks before Christmas, with shoppers carefully watching their budgets.”

He highlighted that many consumers had cut back on traditional and festive classics such as Christmas puddings (-16%) and seasonal biscuits (-11%). Shoppers also popped fewer corks this year, with sparkling wine sales falling by 8%. However, both beer (+1%) and still wine (+2%) were more popular than in 2018.

Overall, average household spending during the 12 weeks fell by £8 to £1,055, while total volume sales slipped 0.7%. Meanwhile, like-for-like prices only rose by a 0.9%, which was good news for consumers looking to control festive bills, but the low level of inflation did little to boost the market.

Lidl was again the fastest growing supermarket chain with sales growth of 10.3%. It performed particularly well with branded products, where sales were up 24%. Together with Aldi, the discount retailers took their highest ever combined Christmas market share. McKevitt commented: “At the end of the decade, it’s worth remembering just how quickly Lidl and Aldi have grown. Their current combined market share of 13.7% is more than treble what they held in December 2009, an unprecedented increase over the course of ten years.”

Individually, Aldi’s sales were up by 5.9%, and its market share grew by 0.4 percentage points to 7.8%. Sales of the supermarket’s Specially Selected range rose by £18m, the highest rate among all retailer premium own label lines.

Kantar highlighted that the slow market had made it particularly difficult for the Big Four retailers to increase sales and they were especially impacted by customers choosing to make one fewer trip to stores in the latest period.

Sales at Sainsbury’s fell by 0.7%, although its market share held relatively firm, dipping by just 0.1 percentage points to 16.0%. Sainsbury’s online sales were a highlight, increasing by 7% with a total 1.1 million users over the period.

Meanwhile, Tesco sales were 1.5% lower, with its share down by 0.4 percentage points to 27.4%. Asda and Morrisons also saw sales fall by 2.2% and 2.9% respectively, with their market shares also dropping.

The Co-op’s 3.0% growth was ahead of the market, and enough to increase its share by 0.2 percentage points to 6.1%. Much of its success was fuelled by chilled products, with fresh poultry sales up by 10% and convenience items like pizza up 9%.

Waitrose’s market share remained at 5.0%, unaffected by a 0.9% fall in sales. Iceland on the other hand enjoyed a bright festive spell, with its sales rising by 1.3% after a recent newspaper coupon campaign helped to attract an extra 390,000 shoppers through its doors.