Latest data from Kantar shows take-home grocery sales in Ireland increased by 4% in the four weeks to 14 April, boosted by shoppers spending more than usual in preparation for the Easter and school holidays.

Volumes per trip increased slightly by 0.4%, as did visits to store (up 1%), with shoppers making 21.5 trips on average over the month of April. Average price per pack grew more marginally this month at 0.7%.

Meanwhile, grocery inflation stood at 2.9% (compared to 3.7% last month) over the 12 weeks to 14 April, down 12.9 percentage points compared to the same period last year. Although value sales were up this month, Kantar noted that grocery price inflation was still the main driving factor behind this rather than increased purchasing.

“This is the twelfth month in a row that there’s been a drop in grocery inflation, so more good news for consumers,” said Emer Healy, the research group’s Business Development Director.

“It’s the lowest inflation level we have seen since March 2022. What’s more, our latest pressure group survey shows that Irish consumers have a more positive outlook with fewer people struggling financially thanks to the easing of inflationary pressures. Around a quarter of shoppers admit they are still struggling, and while this is still significant, it’s a big improvement on the 32% who reported the same last October.”

The data confirmed that shoppers in Ireland remained on the hunt for value when it came to their Easter purchases, with 24.9% of sales going through the till being for items on promotion, down 3.7% since January 2024. This was higher for Easter eggs, with over 43% of value sales on promotion.

Retailers also pushed own-label lines to get shoppers through the doors. Sales of own-label products performed strongly, growing ahead of the total market at 6.5% year-on-year and holding value share just shy of 48%. Over the 12 weeks, shoppers spent an additional €97m year-on-year. Premium own-label ranges also performed well, with shoppers spending an additional €18.7m on these lines and growth of 12.9% when compared to this time last year. Brands saw growth of 3.9%, slightly behind the total market.

Healy commented: “An early Easter didn’t affect seasonal confectionary sales this year as spending topped €23.9m for the first time ever in the days leading up to Easter Sunday. While rising prices played a major role, the number of chocolate Easter eggs sold in the seven days to Easter was also 22% higher than this time last year, with nearly 34% of Irish consumers buying one during this period. A record €9.9m was spent on Easter eggs alone, while many also opted for hot cross buns with shoppers spending over €1 million over the week, up 7.7% on last spring.”

Online sales were up 19.5% year-on-year, with shoppers spending an additional €33m via the channel. New shoppers contributed an additional €14.1m to online’s performance, alongside more frequent and larger trips boosting performance.

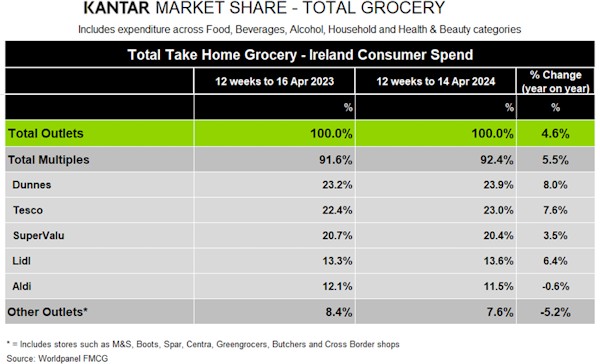

Looking at the leading grocery retailers, Dunnes remained number one, with a market share of 23.9% after delivering sales growth of 8% year-on-year. This stemmed mainly from more frequent trips, up 4.1%, together with new shopper recruitment, which contributed a combined €32.8m to its overall performance.

Tesco held 23% of the market, having grown sales by 7.6%. It had the strongest trip frequency growth amongst all retailers, up 8.9%, which contributed an additional €62.3m to its overall performance.

SuperValu controlled 20.4% of the market with growth of 3.5%. The chain’s shoppers made the most trips in-store compared to all retailers, an average of 21.8, and it saw the strongest growth in volume per trip amongst all retailers, up 5.8%, which contributed an additional €37.4m to its overall performance.

Lidl held a 13.6% share after seeing growth of 6.4%. More frequent trips contributed an additional €33m to its overall performance.

Aldi’s market share slipped to 11.5%. Its sales were down 0.6%, although new shopper recruits, alongside more frequent trips, contributed an additional €8.4m to overall performance.

NAM Implications:

- The combination of extra spends on premium and regular own-label…

- (and the realisation that the perceived quality difference was less than expected)

- …could be a challenge for branded suppliers hoping to win back custom for their brands…

- …unless the brand premium is reduced via a price drop?

- Meanwhile, Aldi’s loss of share (and playing second fiddle to Lidl)…

- …must be a cause for concern in Ireland, the UK and in the home country.

- More importantly, what will Aldi do about it…