Latest data from Kantar shows take-home grocery sales in Ireland increased by 5% in the four weeks to 23 January, with record price inflation of 16.3% driving growth.

The study noted that the average price per pack rose 14.6% in January, while volume per trip was down 13%, highlighting the challenges Irish shoppers are facing.

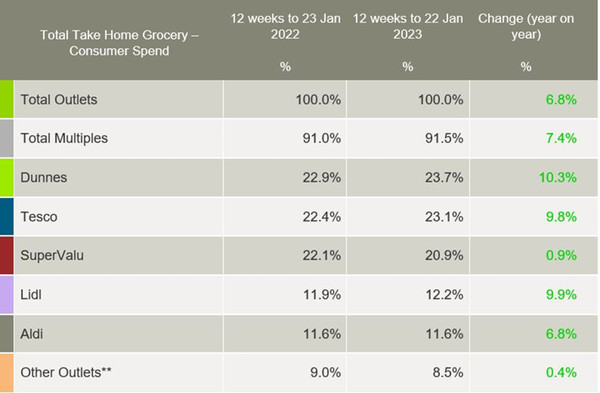

In the 12-week period to 23 January, take-home grocery sales increased by 6.8%, with shoppers contributing an additional €211.8m to the overall market performance. As a result, shoppers spent an additional €90.50 per household year-on-year due to rising prices.

Emer Healy, Senior Retail Analyst at Kantar, commented: “The sector growth comes as grocery price inflation hit 16.3% – the highest level seen since Kantar started tracking grocery inflation. However, this does trail just behind Great Britain, where inflation hit 16.7% after two months of slight decline. Irish households will now face an extra €1,159 on their annual shopping bills if they don’t change their behaviour to cut costs”.

With consumers keeping an eye on their grocery budget after indulging during the festive period, shoppers continued to trade down to supermarket own-label products this period, with sales rising 10.4%, well ahead of a 4.7% increase in branded lines.

Sales of premium own-label lines reached €152.6m, up €5.7m from last year with €26.7m of that coming from premium own-label chilled convenience products in the 12-week period, a growth of 11.6%. Value own-label lines saw the strongest growth, up 34% year-on-year with shoppers spending €17.9m more on these ranges.

Kantar noted that the Irish grocery market is more competitive than ever before, with shoppers looking for the best deals and retailers looking to retain customers. This is reflected by many supermarkets using their loyalty schemes to help shoppers save. According to Kantar’s LinkQ data, nearly 38% of shoppers claim to always use a money-saving voucher. As a result, the amount bought on promotion has fallen to 27.7%, the lowest level for five years, exaggerating the usual post-Christmas drop-off in deals.

Meanwhile, online grocery sales remained strong during January, up 5.6% year-on-year, with shoppers spending an additional €8.5m in the channel. An influx of new shoppers boosted online sales, with nearly one in five Irish households now purchasing online.

Dunnes Stores held the highest share amongst all retailers at 23.7%, with sales growth of 10.3% year-on-year. This stemmed from an influx of new shoppers in-store, up 1.34 percentage points, and shoppers returning more often contributed an additional €24.9m to their overall performance.

Tesco was close behind with 23.1% market share and growth of 9.8% year-on-year. The UK retailer also had the strongest frequency growth amongst all retailers, up 10% year-on-year.

SuperValu now holds 20.9% of the market after seeing 0.9% growth. Among the Irish grocery retailers, SuperValu shoppers make the most trips in-store with 20.8 trips on average, up 9.2% year-on-year.

Lidl controlled 12.2% of the market after 9.9% sales growth year-on-year. New shoppers and more frequent trips contributed an additional €25.5m to its overall performance. Aldi held 11.6%, with 6.8% growth after new shoppers and more frequent trips contributed an additional €10.8m to its overall performance.

NAM Implications:

- The standout stat has to be the combined shares of Aldi & Lidl at 23.8%…

- …are ahead of market leader Dunnes on 23.7%.

- (Think of the psychological impact on suppliers reassessing their historical views of the discounters)

- Meanwhile, consumers shopping around need retaining via loyalty schemes that will eventually result in stronger pushes for Retail Media…

- …as the key retail players seek to capitalise on buying behaviour insight…

- …to bolster their bottom lines.