Latest figures from Kantar show that take-home grocery sales in Ireland rose 5% in the four weeks to 30 October, driven mainly by an 8.5% increase in the average prices.

Over the longer 12-week period to the same date, grocery inflation rose to another record-breaking high of 13.4% as sales climbed 4.7%, driven by a 4.3% rise in shoppers returning to stores and an 8.7% increase in price per pack. This contributed an additional €115m to the overall market.

In the last month, Kantar’s data showed online sales returned to growth, up 13.1%. This was driven by a rise in the number of new shoppers contributing €2.4m to the channel’s overall performance, followed by an increase in the average number of online shopping trips by young families, sitting at 11 compared to only four last year.

Emer Healy, Senior Retail Analyst at Kantar, commented: “As food and drink prices continue to climb alongside a rise in household bills, the impact on shoppers’ budgets is unavoidable for many Irish consumers. With inflation standing at 13.4% for October, the average annual grocery bill will go from €7,019 to €7,960 – an increase of €941 a year if consumers don’t make changes to what they buy and where they shop. At a basket level, that’s an extra €3.80 on top of the cost of the average shopping trip, which currently stands at €28.20.”

She added: “Irish households are looking to manage budgets through a ‘little and often’ approach to shopping. On average, families are adding one extra trip per month, we’re seeing a 9% increase in these smaller trips where less than €30 is spent. In comparison, the extra-large shopping trips where households spend more than €150 have declined by 4%.”

Following the trend seen in the UK, sales of own-label jumped 9.4% over the 12 weeks with shoppers spending an additional €115m year-on-year. Own-label now accounts for almost half (46%) of the overall grocery market in Ireland. Value own label ranges saw the strongest growth, up 27%, with shoppers spending €13.3m more year-on-year. Dairy products had the biggest market share (42.2%) within these value ranges.

Healy said: “It’s interesting that shoppers are also beginning to seek out premium own-label offerings as they move their out-of-home spend in-home as a means of controlling their discretionary spending. As a result, shoppers are spending an additional €5.3m on premium offerings, including spending an additional €902k on toiletries, €800k on fruit and €676k on chilled ready meals.”

Kantar noted that retailers seeing growth during the period have been meeting consumer demand for better deals through own-label products and by offering shoppers Clubcard deals or vouchers for shoppers.

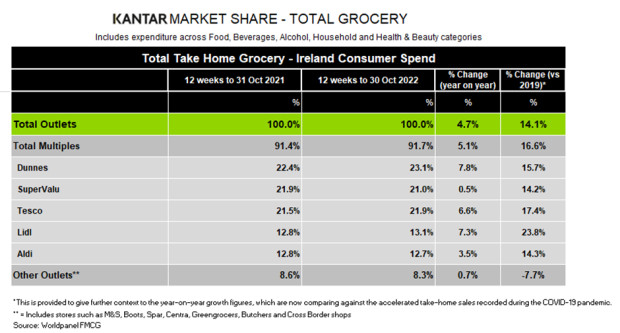

Dunnes had the biggest share of the market at 23.1%, growing 7.8% year-on-year. This growth stems from a 3.5 percentage point increase in new shoppers to store, contributing an additional €35.1m to its performance.

Tesco now holds 21.9% of the market, increasing by 0.4ppt compared with last year. Sales growth of 6.6% was boosted by more frequent return trips by customers. SuperValu posted particularly strong results across the first year of the pandemic and the latest data is the first period of growth since April 2021, with sales up by 0.5%.

Lidl holds 13.1% share, growing 7.3% year-on-year as new shoppers in store and existing shoppers returning more often contributed a combined additional €17.7m to the overall performance. Aldi holds 12.7% of the market, growing 3.5% year-on-year, with existing shoppers returning to store more often contributing to its overall performance.

Meanwhile, Kantar noted that fewer people are stocking up for Christmas in October. Healy commented: “This time last year 30% of Irish households had already purchased seasonal biscuits, whereas only 23% have this year. And this also rings true with chocolate as shoppers are spending €2.1m less on gifting chocolate and €1.2m less on seasonal chocolate. The exception to this is mince pies, as consumers have already spent an additional €220k on these festive treats compared to this time last year.”

NAM Implications:

- The key is that Lidl & Aldi have a combined share of 25.8%, greater than any other multiple.

- And their combined growth greater than any other multiple…

- …means their combined share will grow at the expense of the mults.

- Meanwhile, the consumer appears to be taking inflation fairly well.

- However, 13.4% inflation for October, means annual €7,919 grocery bill will rise €941 for repeat purchasing.

- Own-label now 46% of the grocery market…