Latest data from Kantar shows that grocery price inflation fell for the seventh month in a row during the four weeks to 1 October to 11%, the lowest rate since July 2022 as the cost of some cost everyday items started to fall. Take-home grocery sales over the same period rose by 9.1%, with an increase in promotions and the sunny weather keeping consumers spending despite the higher prices.

Tom Steel, strategic insight director at Kantar, commented: “For the first time since last year, the prices of some staple foods are now dropping, and that’s helping to bring down the wider inflation rate. Dairy was one of the categories where costs really shot up last autumn, but the average price paid for a 250g pack of butter is now 16 pence less than 12 months ago.”

Kantar noted that a jump in the amount of money spent on offers is also helping to offset the impact of inflation. Steel said: “Supermarkets are looking at all the different ways they can deliver value at the tills, and while the emphasis for some time has been on everyday low prices, the retailers are starting to get the deal stickers out again. Spending on promotions made up over a quarter of all sales in the latest 12-week period at 26.5%, the highest level since June 2022.”

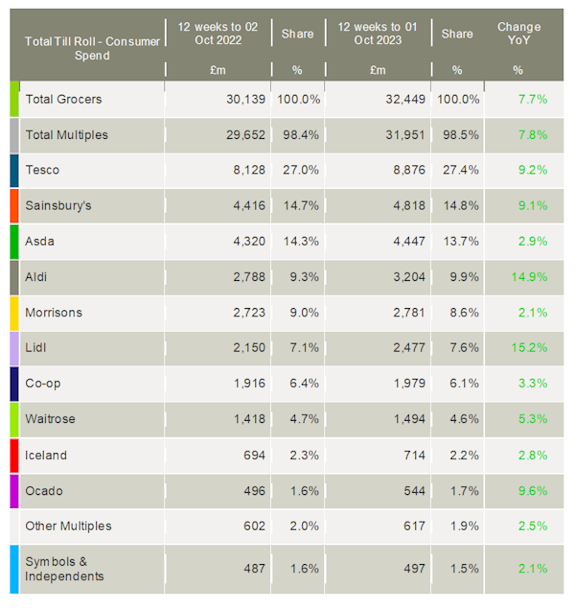

Tesco has been driving the increase in promotions, with some positive results. The UK’s leading grocer saw its sales rise by 9.2% over the latest quarter, with its market share increasing 0.4 percentage points to 27.4%.

Brands also did well as promotion sales hit their highest rate since January this year, helping the category grow sales by 7.3% across the 12-week period. This helped narrow the gap with own-label lines, which grew by 10.1%.

Meanwhile, after a generally disappointing summer, the higher-than-average temperatures during September provided a welcome boost to the sector, with volume sales of ice cream, burgers and dips climbing 27%, 19% and 10% respectively.

Lidl was the fastest-growing grocery retailer this month, with its sales up 15.2% and market share increasing 0.5 percentage points to 7.6%. This is the first time the discounter has led the pack and overtaken Aldi in growth terms since April 2023.

Aldi’s sales were up by 14.9%, with its share of the market growing 0.6 percentage points to 9.9%.

Sainsbury’s share grew to 14.8% after its sales increased by 9.1%. Asda and Morrisons continued to lose market share and now hold 13.7% and 8.6% of the market.

Amid reports that Waitrose could become the latest retailer to partner with Amazon for grocery delivery services, Kantar noted that total online trips increased year-on-year for the first time this month since December 2021 by 3.1%.

NAM Implications:

- Key standout has to be the discounter’s combined share of 17.5% and growing…

- Tesco and Sainsbury’s growing at the expense of Asda and Morrisons.

- Grocery inflation, albeit falling, is still an eye-watering 11%.

- Meanwhile, own-label still growing by 10.1% has to be a concern for brands…