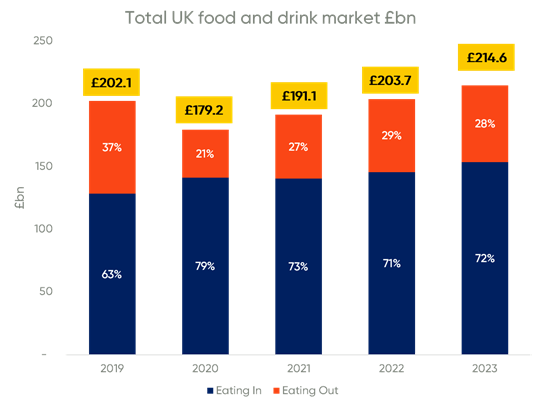

The total food and drink market across eating in and out is forecast to grow 6.6% to £203.7bn this year versus 2021, with a further uplift of 5% in 2023, according to new forecasts from IGD’s Eating In Vs. Eating Out report. However, when inflationary price increases are stripped out, the picture is very different, with a 2% decline this year vs 2021.

The study predicts that eating in (retail) will account for 71% of the market this year, with eating out (foodservice) at 29%. Whilst eating out has seen a recovery from the 21% share during the height of the pandemic in 2020, the channel is still some way below its pre-Covid share of 37% in 2019.

Source: IGD Channel Forecasts and Eating Out Forecast

IGD forecasts that the retail channel will steal share of stomach from foodservice in 2023 as cash-strapped consumers shun eating out. However, it notes that retail wins from foodservice will be mostly offset by down-trading by shoppers i.e. cheaper products, buying less and switching to own-label.

Nicola Knight, Insight Manager and Eating Out sector expert at IGD, said: “In 2020 lockdowns forced a strong switch from eating out to eating in, with 2021 showing a gradual return as venues opened and consumer confidence and appetite for going out increased. However, from Q4 2022 and into 2023 there will be a halt to this trend as retail channels start to steal share of stomach from foodservice, reflecting the challenging economic landscape.”

Retail has already been experiencing the impact of the increased cost of living on shoppers. In real terms, the UK retail market for food and drink is expected to fall slightly in 2023 as consumers trade down to cheaper options.

Knight commented: “Retailers are implementing a variety of initiatives to win and retain shoppers. These are mainly focused on promoting value and loyalty schemes. This looks set to continue into 2023 as shoppers remain very price sensitive.”

NAM Implications:

- Given that ‘real demand’ has to be net of inflation…

- …these IGD figures are showing a serious situation for foodservice…

- …suggesting that any foodservice growth will be at the expense of rivals i.e. a more attractive relative competitive appeal.

- (Winning share back from retail would be a far greater challenge)

- Retailers at least have the opportunity to gain from cash-strapped consumers trading down from brands to own-label while in-store.

- We believe that all stakeholders should work on that basis for 2023 & 2024, minimum!

- (Keep in mind that unprecedented means unprecedented…)