New industry figures show that shoppers in the UK spent £3.6bn on groceries at convenience stores in the four weeks ending 13 August, with the channel growing its share of sales to 28.9% as people shopped locally during the recent heatwave.

The NielsenIQ data reveals that over the four-week period, total till grocery sales grew 4.5%, boosted by price inflation. This growth was exceeded by convenience stores, which rose 5.4%. Convenience stores also experienced an uplift in volume sales (+2.7%) compared with a 3.8% volume decline at the major supermarkets.

NielsenIQ’s data showed that 21% of the total sales within convenience stores were on fresh foods where value sales increased 13%. Sales of frozen foods jumped 29%, as did produce (+8%) within this channel. Shoppers also purchased more as they sought to socialise and celebrate the warm weather and shop locally. Key category volume rises included ice cubes (+44%), ice cream (+31%) and frozen desserts and cakes (+31%).

Across the industry as a whole, the summer holidays increased travel opportunities while the summer heatwave encouraged shoppers to visit stores more often, leading to an uplift in visits to physical stores of 8%.

However, the boost to in-store visits came at the expense of online sales, which fell by 8.7%. The online share of FMCG sales slipped to 11.3%, down from 11.5% in July and 12.9% share a year ago.

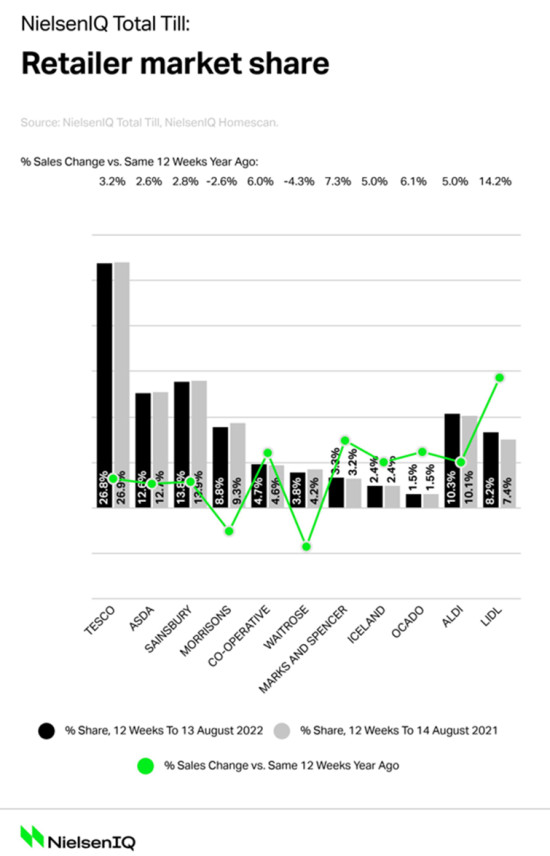

In terms of retailer performance in the 12-week period ending 13 August, Aldi achieved a 10% market share, making it the fourth largest retailer in terms of sales, behind Tesco (26.8%), Sainsbury’s (13.8%), and Asda (12.6%).

Morrisons and Waitrose were the only retailers to experience a sales decline over the period, down 2.6% and 4.3%, respectively. M&S sales were up over 7% and its shopper penetration in the last four weeks reached almost 20% of British households.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, commented: “It is inflation which is driving topline sales across the industry, but shoppers continue to be very cautious about how much they spend on groceries, resulting in a fall in volume sales at supermarkets. However, the hot weather over the last few weeks has helped volumes turn positive at convenience stores, with an increase in purchasing of drinks, frozen and fresh foods in particular. Shoppers made extra visits to their local stores when the sun came out and sales at Co-ops increased 9% in the last four weeks, making them the fastest growing retailer during the recent hot weather.”

He added: “The market may have recovered from a low point in March, but we are now seeing the start of ‘peak inflation’ and we anticipate shoppers will need to reign in their spending again after the ‘back to school’ period in a few weeks’ time. As inflation continues to bite, retailers that focus on saving shoppers’ money will be the ones that maintain sales momentum, and it will those who are most agile and are able to adapt to another change in shopper behaviour that will be able to weather the storm. The battle for loyalty is not going away especially in a time where basket spends are falling and shopper promiscuity is up.”

NAM Implications:

- Anticipate battles as

- Inflation reaches 18%

- Morrisons fight to regain top four Mult position

- Waitrose chases volume growth

- Retailers push own-label at expense of brands

- Brands want return on their Retail Media expenditure

- Everyone fights for their ‘fair share’ of the squeezed middle

- i.e. all need to optimise relative competitive appeal…

- …with two fingers crossed!