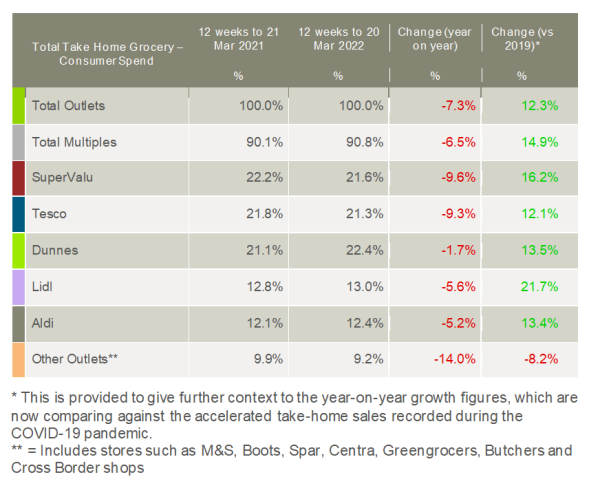

Latest take-home grocery figures from Kantar show that supermarket sales in Ireland fell by 7.3% over the 12 weeks to 20 March. Sales were still up on 2020, although only by 1.3% as the comparison now includes the record demand for groceries before the first national lockdown in March 2020.

In the latest four-week period, sales have declined by 7.7% with Irish shoppers spending €78.2m less on take-home groceries. Emer Healy, senior retail analyst at Kantar commented: “All our remaining Covid-19 restrictions have eased across Ireland and that’s making its mark on grocery sales. Not only are people heading back to the office, but they’re also enjoying returning to pubs, cafés, and restaurants, and as a result are picking up more food while on the go, rather than from the supermarkets.”

The end of restrictions has coincided with price rises across the retail sector, and grocery inflation in Ireland now stands at 3.7% – the highest level since October 2013. Healy said: “As spiralling costs bite at the heels of retailers and shoppers, supermarket prices are being pushed up. The number of products sold on promotion has dropped by 5.7% as the grocers look to mitigate supply chain pressures, and we’ve seen a marked increase in the average price of staples like bread, butter and toilet paper over the last 12 weeks.”

Kantar noted that inflation, rather than the pandemic, is now the main driver of changes to consumer behaviour in Ireland. Healy commented: “This is a stressful time for consumers and that anxiety is being felt on the shop floor. With promotions down, shoppers are focused on seeking out cheaper alternatives. Private label’s share of the grocery market is on the rise and has grown by 1.2% since last year. Retailers’ own lines now account for 46.3% of total grocery sales. Headlines around shortages of pasta and flour have also seen sales of those products soar, with both categories boosted by 22% and 30% respectively during the month of March.”

Kantar’s latest data period marks two years since the first lockdown in Ireland with the firm noting that it has become clear which pandemic grocery habits are here to stay. “The growth of online shopping has been one of the most staggering shifts to shopper behaviour in recent memory, with all retailers now offering some form of online shopping,” said Healy.

“Since 2018, online’s share of the market has grown by 3.1 percentage points, a boost largely driven by couples without children who are natural converts to online technology. Since the same period in 2018, the proportion of this demographic buying online has nearly doubled, going from 14% to 26% in March 2022. By 2024, we estimate that online will hold a 6.6% share of total grocery sales – a figure which would have seemed crazy before Covid-19 came along.”

Kantar also highlighted that the recent increase in cooking from scratch remains reflected at the tills. Sales of home baking and home cooking ingredients continue to see strong growth, increasing 14.6% and 20% respectively since 2019.

Meanwhile, hybrid working means sales of hot beverages shot up by 23% over the latest period compared with pre-pandemic when people spent most of their time in the office.

All of the major retailers saw take-home grocery sales fall in the latest 12-week period. Healy commented: “The competition between the grocers is ramping up as people hunt for the best deals. Those grocers with strong messaging on lower average prices and promotional offers are best placed to come out on top.”

Dunnes retained its position as Ireland’s largest grocer and holds a 22.4% market share this period. SuperValu pipped Tesco to second place, with the retailers claiming a market share of 21.6% and 21.3% respectively. Lidl follows behind with a 13.0% share of the market, while Aldi holds 12.4%.

NAM Implications:

- The combined share of the discounters at 25.4% (and growing) has to be an issue vs any mult.

- And a switch to own-label must be of concern to brand owners…

- …especially with more inflation coming out of the pipeline.