Latest data from Kantar shows that take-home grocery sales in Ireland increased by 8.5% in the four weeks to 1 October, with price inflation still the driving factor.

Over the full 12-week period, the average price per pack climbed 8.7%, while overall grocery inflation was 10.5%. This was down from 11.5% in the last quarterly period.

Kantar noted that shoppers visited stores more often last month, up 5.9% and making an average of 20.5 trips. However, with consumers still facing budget pressures, volumes per trip continued to decline compared to last year, down 7.3%.

Emer Healy, the firm’s Business Development Director, commented: “It’s more welcome news for shoppers that inflation has fallen for the fifth month in a row. Although there is promise in the current trajectory, and this marks the lowest level of inflation we have seen since September 2022, the fact is that inflation still remains high.”

She noted there was currently a drop in the level of sales sold on promotion. Back in 2020, 27.7% of sales in Irish supermarkets were on promotion versus 24.4% this year. This is down 3.3 percentage points when compared to 2020.

Kantar highlighted that on current levels of inflation, unless consumers make changes to their shopping habits, the average annual grocery bill is set to rise by €176 to €1,853.

Own-label goods remained popular in the latest 12 weeks, with sales up 11.5% compared to brands which grew by 5.1%. Value own-label ranges continued to see the strongest growth at 13%, with Irish shoppers spending an additional €7.7m year-on-year on these lines in a bid to save money.

Online sales in Ireland remained strong, up 25.2% year-on-year, with shoppers spending an additional €36.1m in the channel. The period saw more frequent trips, up 5.6%, with an increase in shoppers venturing online, resulting in 18% of Irish households now purchasing groceries online.

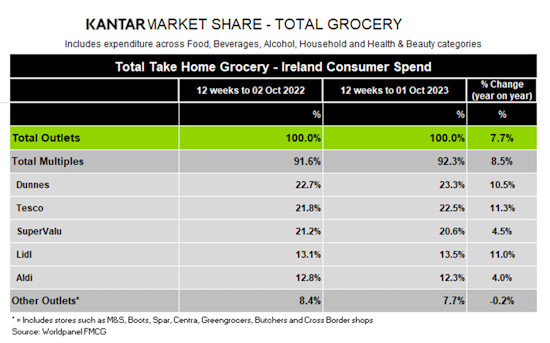

Dunnes held 23.3% on the market, with growth of 10.5% driven by a boost in new shoppers, up 3.24 percentage points year-on-year – the biggest increase in new shoppers amongst all the retailers.

Tesco controlled 22.5% of the market after delivering market-leading growth of 11.3%. It saw the strongest frequency growth amongst all retailers again, up 15.8% year-on-year, which contributed an additional €94.1m to overall performance.

SuperValu held 20.6% of the market with growth of 4.5%, which is a 0.5 percentage point increase compared to last month. SuperValu shoppers made the most trips in store compared to other retailers, an average of 21.7, and picked up more volume per trip, contributing an additional €5.9m to their overall performance.

Lidl’s share rose to 13.5%, with growth of 11% driven by more frequent trips, which contributed to an additional €43.2m to overall performance. Aldi held 12.3% with growth of 4% year-on-year. It benefitted from a boost in new shoppers and more frequent trips, which contributed an additional €27m to overall performance.

NAM Implications:

- Inflation lower, but prices rising, albeit more slowly.

- Consumers shopping more often, but more efficiently…

- …meaning less wastage.

- Meanwhile, own-label growing at 2x brands has to be of concern to suppliers.

- (From a retailer’s POV, as Retail Media becomes more important, retailers will need to shift the emphasis back to brands…)

- Meanwhile, the discounters combined share of 25.8% remains a threat to rivals…