Latest Kantar data shows that take-home grocery sales growth in Ireland more than doubled in the four weeks to 19 February to 10.2%, with record-breaking inflation of 16.4% the main driver.

With the average price per pack soaring 13.4% in February, the data suggests that Irish consumers are coping with the increased cost of food and drink by shopping little and often. Volume per trip was down 10.9%, while frequency was up 7%.

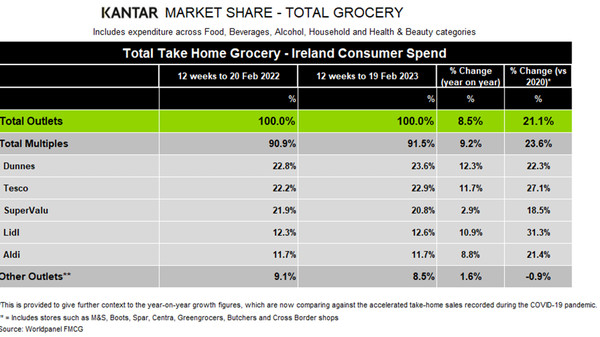

In the 12 weeks to 19 February, take-home grocery sales increased by 8.5%, with shoppers returning to stores more often and contributing an additional €168.7m to the market’s overall performance. As a result, shoppers spent an additional €113.56 per buyer, compared with the same period last year.

Emer Healy, Senior Retail Analyst at Kantar, commented: “This growth in sales is largely down to grocery price inflation hitting 16.4%, a new record high. This time last year it was 2.4% so a significant 14% increase within 12 months. In a year of rising costs and sky-high inflation, Irish consumers are looking for ways to manage their household budgets. This has led to the Irish grocery market becoming more competitive than ever, with shoppers looking for the best deals among the retailers.”

As with the UK, the market in Ireland is seeing much stronger own-label growth (11.9%) compared to brands (6.1%) as shoppers look for ways to save money. Own-label value share has also risen from 42.6% in 2021 to 45% in 2023. Value own-label lines saw the strongest growth year-on-year, up 35.8%, with shoppers spending €19m more on these ranges.

Online sales remained strong over the 12 weeks period, up 5.2% year-on-year with shoppers spending an additional €8m online. An influx of new shoppers boosted online sales by €7.1m, with nearly 18% of Irish households purchasing online.

Dunnes held the highest share amongst all retailers at 23.6%, with sales growth of 12.3% year-on-year. Tesco was close behind in second place, with the latest data showing the retailer’s shopper footfall at its highest level since January 2020. 79.9% of households visited a Tesco store at least once, with the highest increase seen in Connaught/Ulster – home to the recently acquired chain of former Joyce’s stores.

SuperValu held 20.8% of the market after seeing growth of 2.9% – the strongest level for the retailer since April 2021. SuperValu shoppers made the most trips in store compared to all retailers, with 20.8 trips on average, up 10.5% year-on-year.

Lidl saw growth of 10.9% after an influx of new shoppers and more frequent trips contributed to an additional €21.2m to its overall performance. Aldi’s growth of 8.8% came from similar trends, contributing to an additional €31.2m to its overall sales.

NAM Implications:

- NB. Inflation has moved from 2.4% to 16.4% in 12 months!

- …means that much of the resulting impact has yet to emerge.

- Value own-label lines up 35.8%, pose the real threat to brands,

- Especially given consumers’ reluctance to revert to brands when the economy improves.

- At a combined market share of 24.3%, Aldi & Lidl are greater than market leader Dunnes at 23.6%.

- Meanwhile, leader on trip frequency SuperValu’s shoppers, at 20.8 trips on average, up 10.5% year-on-year…

- …has to represent an additional concern for Dunnes and Tesco.