Latest data from Kantar shows take-home grocery sales in Ireland increased by 6.8% in the four weeks to 6 August, with price inflation still the driving factor behind the uptick rather than increased purchasing.

Average price per pack climbed 8.8% last month, while overall grocery inflation rose by 12.8% in the 12 weeks to 6 August. This was down from 14.7% in the last period and is the lowest level since November 2022.

Emer Healy, Business Development Director at Kantar, commented: “This is the third month in a row where there has been a drop in grocery inflation, which is welcome news for Irish consumers, although the rate is still incredibly high.”

Kantar expects to see a continued gradual decline in inflation rates over the coming months, with Healy saying: “The good news is that the slowdown in grocery inflation is starting to come through in prices on the shelf. Compared to May 2023, when grocery inflation hit its highest peak of 16.5%, we are starting to see a slight decline in average prices on essential lines. As a result, we are spending €0.36 less on butter, milk and cheese combined.”

The percentage of packs sold on promotion declined by 2.8 percentage points versus 2020, while the percentage of sales sold on promotion stands at 24.8%, which is down slightly on last year’s 0.2 percentage points. With fewer items on promotion, Irish shoppers are said to be looking out for the best deals in the market.

Own-label goods remain popular, with sales up 13% in the 12 week period, compared to brands at 5.7%. For the third consecutive month, own-label retains a higher share of the market than brands, hitting a value share of 48.1% compared to branded share at 46.3%.

Healy said: “Buying own-label lines is one of the ways in which Irish consumers have been trying to save money at the tills, and we can see the impact of this on their spend. The average increase in the household weekly grocery shop is €9.10 compared to last year, well below the extra €17.80 shoppers would have paid if they bought the same items 12 months ago based on the current rate of inflation”.

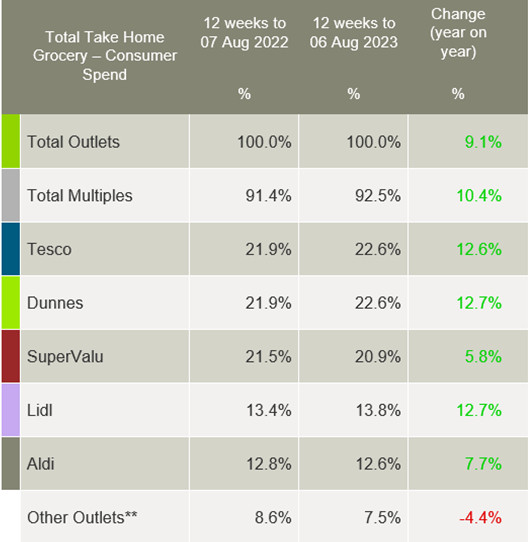

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month. The gap between the top three retailers continues too close, with Tesco and Dunnes holding the combined highest share.

Dunnes holds 22.6% with growth of 12.7% year-on-year. This growth stems from shoppers returning to store more often, up 4.2% year-on-year, along with recruiting new shoppers to store, up 1.3 percentage points.

Tesco also holds 22.6% of the market with growth of 12.6% year-on-year. Tesco had the strongest frequency growth amongst all retailers again, up 16.9% year-on-year, contributing an additional €98.8m to overall performance.

SuperValu holds 20.9% of the market with growth of 5.8%. SuperValu shoppers make the most trips in-store when compared to all retailers, 22.2 on average, which is up 5.8% year-on-year.

Lidl holds 13.8% share with growth of 12.7% year-on-year. More frequent trips contributed to an additional €40.9m to overall performance. Aldi holds 12.6% with growth of 7.7% year-on-year thanks to an increase in new shoppers and more frequent trips, contributing an additional €34.6m to overall performance.

Meanwhile, online sales remained strong over the 12-week period, up 11.2% year-on-year, with shoppers spending an additional €16.6m online, a significant boost when compared with last month’s 6% increase (€9m). More frequent trips online boosted performance by 12.6%.