Latest industry data confirms that prices in the grocery sector are continuing to rise, with further upward pressure likely to come from the conflict in Ukraine. With the market still contracting from last year’s pandemic-driven highs, Aldi and Lidl were the only physical retailers seeing growth and gaining share on the main multiples, apart from Tesco.

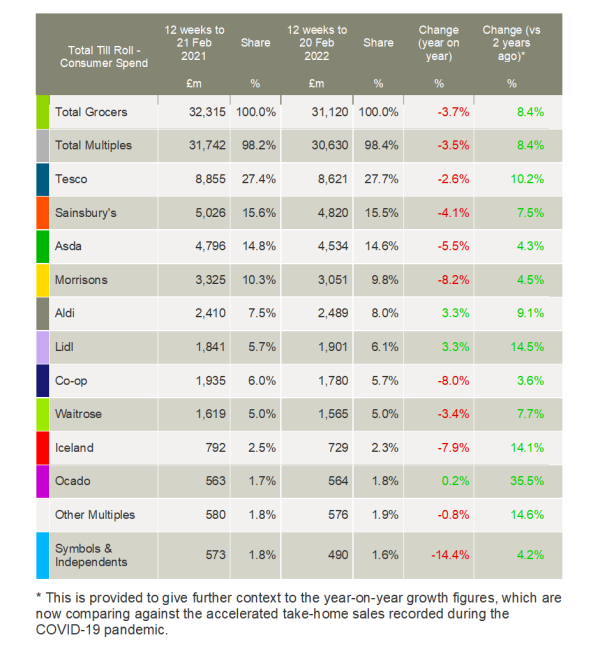

Take-home grocery figures from Kantar show that overall supermarket sales fell by 3.7% during the 12 weeks to 20 February in comparison with last year when the winter lockdown meant people were eating more meals and snacks at home. However, sales remain 8.4% higher than the same period before the pandemic in 2020.

The fall in spending comes despite grocery price inflation accelerating to 4.3% in February, up from 3.8% the month before. Apart from the start of the pandemic, when grocers cut promotional deals to maintain availability, this is the fastest rate of inflation Kantar has recorded since September 2013. Prices were found to be rising fastest in markets such as savoury snacks, fresh beef and cat food, while falling in bacon, beer and lager, and spirits.

“Added to this, ongoing supply chain pressures and the potential impact of the conflict in Ukraine are set to continue pushing up prices paid by consumers,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

In terms of understanding how shoppers are responding, it was a complex picture for the market this month. McKevitt commented: “Households spent on average £26.07 less at supermarkets in February and own-label sales did better than brands for the first time in three months. It’s important to flag that the drop in monthly spending isn’t all down to savvy budgeting. With the formal end to Covid restrictions in England, more of us are now eating on the go, buying sandwiches, salads and snacks on our lunch breaks, and enjoying meals out with friends and family. That means we’re buying less food and drink to have at home.”

However, it appears the discounters look set to benefit from the cost-of-living crisis with Kantar noting that shoppers were making more visits to their stores. Aldi and Lidl were the fastest-growing retailers this period, both increasing their sales by 3.3%. Aldi attracted an additional 1.3 million customers compared with 2021 while Lidl brought in nearly an extra million.

Meanwhile, further evidence that shoppers are moving beyond the pandemic can be seen in online grocery sales, which now account for 13.3% of all spending, down 2.1 percentage points from last year. However, the drop in online spending failed to dent Ocado’s performance. It bucked the wider trend to increase its sales by 0.2% over the past 12 weeks, with its market share growing from 1.7% to 1.8%.

The majority of bricks & mortar retailers saw take-home grocery sales fall this period compared with last year, though all were in growth against 2020. McKevitt said: “Supermarkets with a strong food-on-the-go offer will have enjoyed an added boost that is not reflected in the numbers as people picked up sandwiches, snacks and drinks while out and about again.”

Tesco extended its run of market share gains, taking another 0.3 percentage points. It now accounts for 27.7% of the market. Waitrose also grew ahead of its peers to hold its share of the market flat at 5.0%. However, Sainsbury’s, Asda, Morrisons, the Co-op, Iceland, and independent retailers all saw declines in their market share.

NAM Implications:

- Time for suppliers to justify why they are not optimising their potential business with the discounters?

- Especially given that Tesco and Ocado are the only other retailers growing at the expense of the rest…