Latest take-home grocery figures from Kantar show supermarket sales in the UK rose by 2.2% in the 12 weeks to 7 August, the fastest growth the industry has seen since April 2021.

Grocery price inflation hit 11.6% over the past four weeks, the highest level since Kantar first started tracking the data this way in 2008. Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “As predicted, we’ve now hit a new peak in grocery price inflation, with products like butter, milk and poultry in particular seeing some of the biggest jumps. This rise means that the average annual shop is set to increase by a staggering £533, or £10.25 every week, if consumers buy the same products as they did last year.”

He added: “It’s not surprising that we’re seeing shoppers make lifestyle changes to deal with the extra demands on their household budgets. Own-label ranges are at record levels of popularity, with sales rising by 7.3% and holding 51.6% of the market compared with branded products, the biggest share we’ve ever recorded.”

With inflation high and a recession likely later this year, Kantar noted that comparisons against the last financial crisis are becoming visible. McKevitt said: “People are shopping around between the retailers to find the best value products, but back in 2008 there was much more of a reliance on promotions. It’s harder to hunt out these deals in 2022 – the number of products sold on promotion is at 24.7% for the four weeks to 7 August 2022, while 14 years ago it was at 30%. Instead, supermarkets are currently pointing shoppers towards their everyday low prices, value ranges and price matches instead.

“Over the past month, we’ve really seen retailers expand and advertise their own value ranges across the store to reflect demand. Consumers are welcoming the different choices and options being made available to them on the shelves, with sales of own-label value products increasing by 19.7% this month. As an example, Asda’s Just Essentials line, which launched this summer, is already in 33% of its customers’ baskets.”

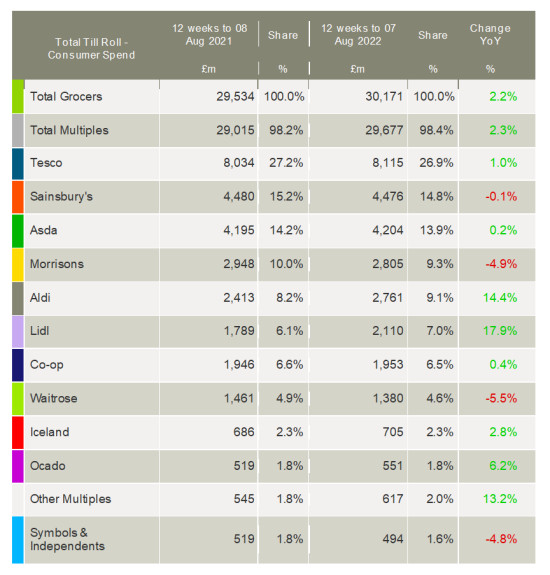

Looking at the performance of individual retailers, Lidl remained the fastest growing grocer, with sales up by 17.9% over the 12 weeks, raising its market share to 7.0%. Boosted by the popularity of its dairy goods and bakery lines, this is the discounter’s highest rate of growth since September 2017. Aldi also performed strongly, and its market share increased by 0.9 percentage points to 9.1%, putting it just 0.2% behind fourth-placed Morrisons.

Together, Lidl and Aldi gained 1.8% of grocery sales in the UK over this period, representing a £2.3bn annual shift in spending towards the discounters.

Meanwhile, after a lengthy period of decline, Asda returned to growth this period with its sales rising by 0.2% to take its market share to 13.9%. The group has recently been ramping up its efforts to attract cash-strapped shoppers to its stores, including rolling out its new value range and Rewards loyalty scheme.

Tesco’s sales increased again this period by 1.0% and it now controls 26.9% of the market. Sainsbury’s and Morrisons saw their sales decline and market shares fall to 14.8% and 9.3%, respectively.

Waitrose saw the biggest fall in sales, down 5.5%, a sign that the upmarket grocer may suffer as more people switch to value-orientated retailers amid inflation and soaring energy prices.

Meanwhile, the online grocery channel saw its total share drop to 11.8% after shoppers made the most trips into stores since March 2020. This is the first time online’s share has dipped below 12% since the early days of the pandemic in May 2020. However, Ocado bucked the overall online sales decline, growing by 6.2% as it attracted new shoppers outside its traditional demographic.

NAM Implications:

- Not much about brands, folks?

- i.e. Brands need to fend off private label

- Meanwhile, Kantar clearly demonstrate that consumers are trading down, shopping around and are hungry for value…

- …with even higher inflation and recession to come.

- Discounters now have a collective share of 16.1%.

- Can you really afford not to pursue your fair share of Aldi & Lidl business?