Latest data from Kantar shows inflation in Ireland’s grocery sector was 9.8% in the 12 weeks to 29 October, dropping into single figures for the first time this year.

Take-home grocery sales during last month increased by 7.2%, while shoppers visited stores more often, with an average of 20.1 trips over the month (up 3.6%). However, volumes per trip continued to decline versus last year, down 5.9%.

Emer Healy, Business Development Director at Kantar, commented: “This is the sixth month in a row that there’s been a drop in inflation, although it’s still high. Compared to last month’s inflation rate of 10.5%, there has been a significant drop of 0.7%. The positive news is that this is the lowest inflation level we have seen since September 2022, and we expect this to continue to decline over the coming months.”

The percentage of packs sold on promotion rose slightly by 0.4% compared to the previous month and now stands at 24.8% – up 6.9% year-on-year and the highest level seen since August 2023.

Meanwhile, own-label value share stood at 47.5% during the period, with brands holding 47.4% – up 0.6% on last month.

Healy said: “Irish shoppers are looking out for the best deals and own-label goods remained popular over the last 12 weeks, with sales up 11% compared to brands at 6.2% (+1.1% on last month). Premium own-label ranges had the strongest growth, up 12.1% with shoppers spending an additional €14.8m year-on-year. It looks like shoppers may be trying to temper their spend and seek savings now through own-label lines so they can splurge on the upcoming holiday season”.

Kantar noted that the general outlook is slowly starting to improve for Irish consumers, with its latest survey revealing that 16% of Irish households expect their finances to improve in the next 12 months.

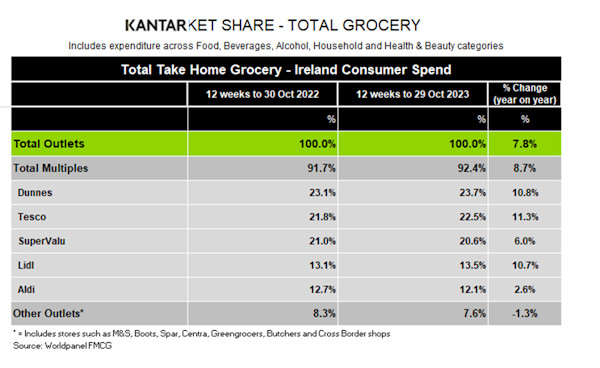

Looking at individual retailer performance, Tesco recorded the strongest sales value growth, up 11.3% year-on-year. It also had the strongest frequency growth amongst all retailers, up 13.1%, alongside new shopper arrivals, which contributed an additional €81.7m to the chain’s overall performance.

Dunnes remained the market leader after growing 10.8%. It benefitted from a boost in new shoppers, up 2.33 percentage points, contributing an additional €23.9m to their overall performance. Dunnes welcomed the strongest growth in new shoppers and volume per trip among all the retailers.

SuperValu saw growth of 6%, with shoppers making the most trips in-store amongst all retailers. An average of 22.3 trips, alongside an increase in volume per trip, contributed an additional €32.6m to their overall performance.

Lidl grew 10.7%, with more frequent trips contributing an additional €43.1m to its overall performance. However, Aldi was up only 2.6% despite more frequent trips contributing an additional €25.9m to its overall performance.

Meanwhile, online sales in Ireland remained strong over the 12-week period, increasing 28% year-on-year, with shoppers spending an additional €39.6m in the channel. More frequent trips, up 2.6%, and new shoppers, up 2.4 percentage points, contributed to online’s overall growth.

NAM Implications:

- With growth coming from deals and own label…

- …life is more costly for brands.

- However, despite inflation coming down slowly…

- …prices are still rising.

- However, the discounters combined share of 25.6%…

- …and Lidl growing at 10.7%…

- …needs watching.