Latest Kantar data shows take-home grocery sales in Ireland rose by 10.9% in the four weeks to 16 April 2023 as the average price per pack increased. However, overall grocery price inflation fell for the first time in almost two years, dropping from 16.8% to 16.6% over the longer 12-week period.

With inflation remaining close to record levels, the research highlights that Irish consumers are turning to shopping little and often to help manage their budgets. They are also returning to store more often, with visits up 10.2%, which contributed an additional €278.4m to the overall market’s performance alongside a significant increase in average price per pack, up 14% year-on-year.

Meanwhile, the market continued to see much stronger own-label growth (15.6%) compared to brands (8%) as shoppers looked for ways to save money. Value own-label saw the strongest growth, up 33.4%, with shoppers spending €18m more on these ranges. Brands hold 47.5% of the Irish market, with own-label holding 46.9%.

Online sales remained strong over the 12-week period, up 4%, with shoppers spending an additional €6.5m online year-on-year. Unlike the total grocery market, shoppers returned to the online platform less often, down 3.5% year-on-year and continue to buy less volume compared to last year (-13.5%). However, online attracted new shoppers who contributed an additional €6.9m to its performance, with 16.5% of Irish households purchasing online.

With frequency driving sales growth, Tesco, SuperValu, Lidl and Aldi all saw growth ahead of the total market during this period.

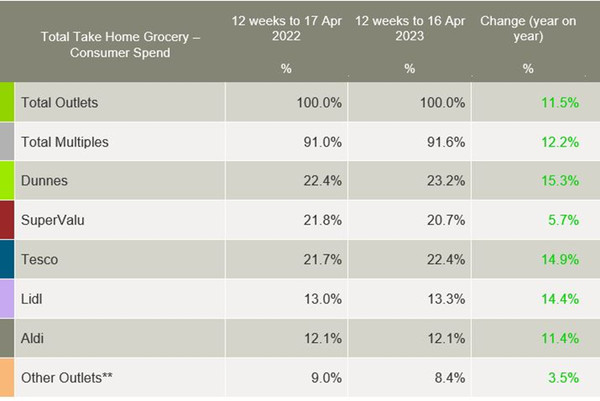

Dunnes held the highest share amongst all retailers at 23.2%, with growth of 15.3% year-on-year. This stems from an influx of new shoppers to store, up 1.4 percentage points, and shoppers returning more often, up 6.9%.

Tesco controlled 22.4% of the market with growth of 14.9% year-on-year. With the strongest frequency growth amongst all retailers (+13.2% year-on-year), Tesco also saw an increase in new shoppers in store, up 1.7 percentage points.

SuperValu held 20.7% of the market with growth of 5.7%. Its shoppers made the most trips in-store when compared to all retailers, an average of 23 trips over the 12-week period, which is up 12.6% year-on-year.

Lidl controlled a 13.3% share of the market after seeing growth of 14.4%. An influx of new shoppers and more frequent trips contributed an additional €43.9m to its overall performance. Meanwhile, Aldi held a 12.1% share after growth of 11.4%. A boost in new shoppers and more frequent trips contributed an additional €55.2m to its overall performance.

NAM Implications:

- Smaller baskets, more frequent shopping also means less wastage.

- Aldi & Lidl combined share of 25.4% share is greater than the mults…

- …has to be a continuing concern to their rivals.

- Meanwhile, the inflationary price rises will slow to a plateau and remain at that level…

- …apart from some tactical cuts to grab the headlines.