Grocery prices across the UK continued to rise for the latest 12-week period, even as supermarket sales edged up for the first time in more than a year, according to the latest figures from Kantar.

For the 12 weeks for 10 July 2022, supermarkets sales were up 0.1%, the first such growth since April 2021. However, like-for-like grocery price inflation for the past four weeks stood at 9.9%, hurt by supply chain issues.

Fraser McKevitt, head of retail and consumer insight at Kantar, noted: “Grocery prices continue to soar to near record-breaking heights and have jumped by another 1.6 percentage points since last month. This is the second highest level of grocery inflation that we’ve seen since we started tracking prices in this way in 2008 and we’re likely to surpass the previous high come August. With grocery price inflation at almost 10%, people are now facing a £454 increase to their annual grocery bills.

“All this means that people will be feeling the pinch during our first restriction-free summer since 2019. Taking a barbecue as an example, buying burgers, halloumi and coleslaw for some al fresco dining would cost you 13%, 17% and 14% more than it would have this time last year. Buying enough for a typical family barbecue, shoppers will have to put aside £9.94 rather than the £9.01 they spent last year.”

Kantar said that shoppers are adjusting their behaviour as prices keep rising, with an increasing shift to own label. McKevitt noted: “Supermarkets’ own lines are growing by 4.1% this period, while sales of branded items have fallen by 2.4%.”

The report also noted a shift in consumer purchasing trends as average temperates soared across the UK. Kantar noted: “Over the past four weeks, sales of ice cream and suncare products soared by 14% and 66%. In July 2019, the last time we faced a heatwave like this, sales of fans, paddling pools and reusable water bottles grew by 107%, 169% and 17% respectively. This added up to a combined total of £10.9m extra spent during the hottest week on just those three categories, and we expect to see similar if not even bigger numbers this time around.”

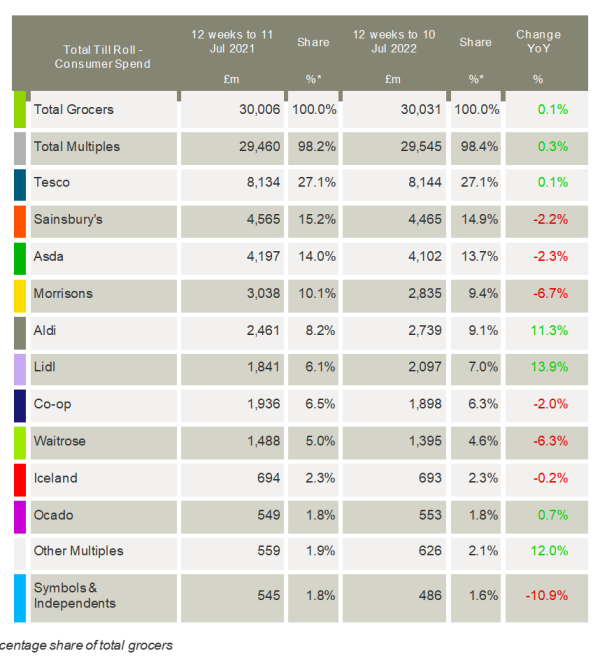

In terms of retailers, Lidl was the fastest growing supermarket again during the period, with sales up by 13.9%. Aldi also grew by double digits, with sales up 11.3% year-on-year. McKevitt noted: “Over 67% of people in Britain shopped in either an Aldi or a Lidl in the past 12 weeks, with 1.4 million additional households visiting at least one of the discounters in the latest three months compared with last year. Both retailers reached a new market share high over the past three months. Lidl now holds 7.0% of the market while Aldi climbed to a 9.1% share.”

Tesco returned to growth during the period, for the first time since October, with sales edging up 0.1% and market share being maintained at 27.1%. Ocado was the only other retailer in growth, holding its market share steady at 1.8% while its sales were up 0.7%.

Sainsbury’s holds 14.9% of the market, followed by Asda at 13.7%, and Morrisons 9.4%. Co-op achieved a 6.3% market share this period and Waitrose stands at 4.6%. Frozen food specialist Iceland held its market share flat at 2.3%.

NAM Implications:

- The key is to be aware of consumer perception of inflation…

- i.e. published at 10% but things you need are somehow 13%, 14% and 15%+

- …and never forgetting the upcoming ‘Winter of Discontent’ (energy prices, strikes more ‘inflation’)

- Best anticipate drastic reductions in spend…

- And plan accordingly…

- Unless you can risk a ‘wait & see’ approach?