Take-home grocery sales fell by 1.2% over the 12 weeks to 3 October, partly because the reduced availability of petrol led to shoppers limiting the number of trips they made to supermarkets.

Despite the dip, the data from Kantar shows sales remain 8.1% higher than they were before the pandemic and every retailer recorded better sales compared with the same period in 2019.

As queues outside petrol stations hit the headlines last month, the average UK household made 15.5 store visits to supermarkets in the past four weeks, the lowest monthly figure since February. Shoppers staying off the roads also meant the proportion of groceries bought online, which has been steadily decreasing over the past seven months, crept up to 12.4% compared with 12.2% in the month before.

“Consumers made the most of their time in store once they did make it to the shop, and trips where people spent over £100 were up by 6%,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

“A minority of very prepared shoppers also took the chance to get ahead on their festive spending as 449,000 eager consumers bought their Christmas pudding in September, with sales 76% higher than in the same month last year. Sales of toys are also up by 5% on last year while gift wrapping products grew by 10%. It’s important to say, however, that these are still relatively small numbers and anxiety around supply issues has not translated to panic buying – festive or otherwise.”

Meanwhile, amid the wave of well-publicised cost headwinds, Kantar’s data shows like-for-like grocery prices rose by 1.7% in the past four weeks compared with last year. McKevitt commented: “In real-world terms, the average household had to spend an extra £5.94 on groceries last month than they did at the same time last year. The typical household spends £4,726 per year in the supermarkets, so any future price rises will quickly add up. Shoppers will look to manage their spend by carefully selecting the products and retailers that offer them the best value.”

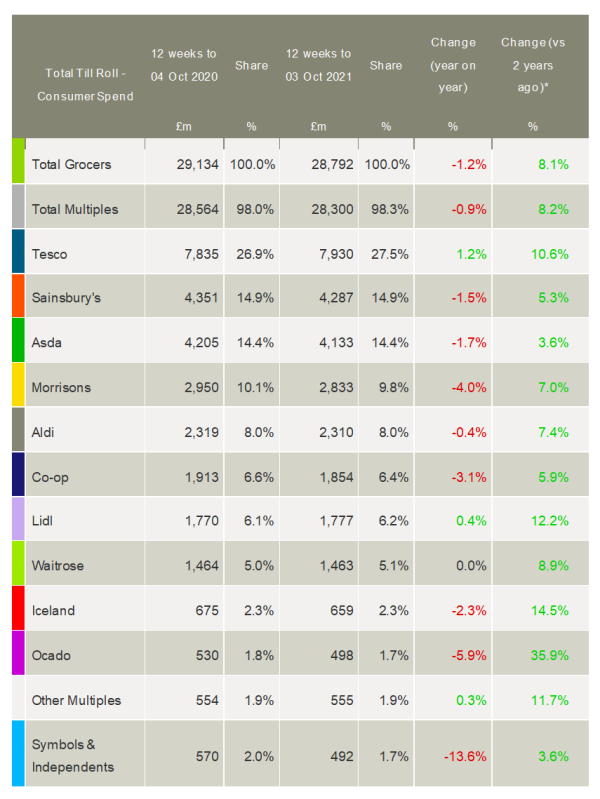

After issuing a positive set of results last week, Tesco continued to grow ahead of the market with sales up by 1.2% year-on-year over the 12-week period. The UK’s leading grocer also saw its market share increase by 0.6 percentage points to 27.5%, its highest level since February 2019.

Lidl was the only other retailer to achieve growth in the period, increasing sales by 0.4% to give it a market share of 6.2% – matching its previous record high in May 2021. Waitrose’s sales remained flat, but this was enough for it to gain market share, nudging up 0.1 percentage points to 5.1%.

Market share was unmoved at both Sainsbury’s and Asda, sitting at 14.9% and 14.4% respectively. Aldi (8.0%) and Iceland (2.3%) also remained steady. As Morrisons’ ownership auction was settled, the retailer’s market share slipped slightly from 10.1% to 9.8%.

Meanwhile, consumer behaviour continued to creep back to pre-pandemic habits and retailers that made significant gains last year are beginning to return to normal. Having benefited from consumers shopping locally during the pandemic, Co-op’s share fell by 0.2 percentage points in the latest 12 weeks to 6.4%. Ocado sales shrank by 5.9% this period, but the online retailer still showed the greatest two-year increase of any retailer, with sales 35.9% higher than in 2019.

NAM Implications:

- Key for suppliers to compare their sales with anticipatory Christmas shopping by cautious shoppers.

- Despite relatively little share movement, worth comparing the detail re your business…

- NB. the discounters are still an issue for Big Retail, despite counteracting moves by the mults…