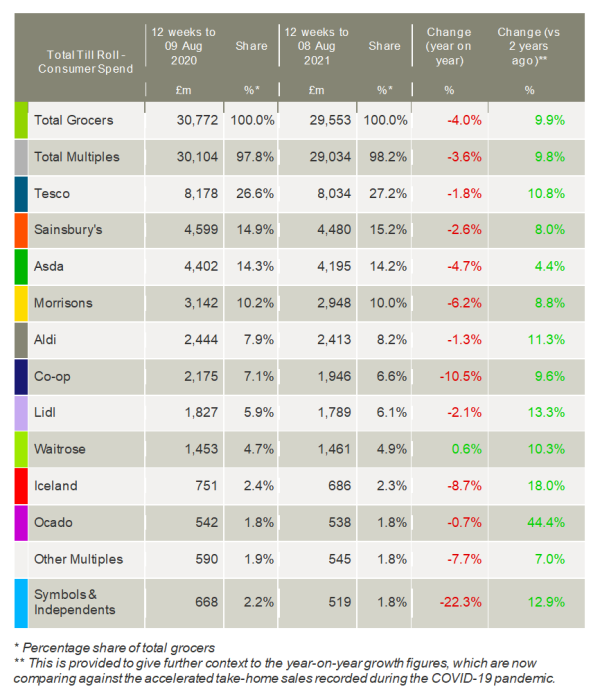

The latest take-home grocery figures from Kantar show sales fell by 4.0% year-on-year during the 12 weeks to 8 August as consumers continued to return to pre-pandemic shopping habits, making smaller but more frequent trips to the stores. However, in the last month, sales declined more slowly by 0.5% and the data shows that Covid is still having an impact on people’s spending as grocery sales remain 9.9% higher in the latest 12 weeks than in 2019.

The gradual return to more traditional behaviour is also affecting online grocery sales. Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Take up of online grocery shopping grew rapidly during the pandemic, but as lockdown restrictions have loosened a divide is beginning to emerge. Those who have come to love the convenience of an online shop are sticking with it, ordering regularly and spending on average more than two-thirds of their total grocery bill online. But the unconverted are starting to drop away, preferring to get back to store instead.”

Kantar’s data suggests just over 20% of the population bought groceries online in the latest four weeks, the lowest level since October last year, while the share of grocery sales made online now stands at 13.0%, down from a peak of 15.4% in February.

This shift away from online contributed to Ocado’s sales falling by 0.7%, its first decline on record. McKevitt said: “Ocado’s growth is now comparing against the rapid expansion it enjoyed in 2020 so it’s not altogether surprising that we’re now seeing a small dip. It’s still a positive outlook for the online specialist though. Ocado has retained 1.8% of total grocery sales, the same as last year, and sales are up by 44.4% compared with 2019, the fastest two-year growth in the market.”

Other retailers, including Amazon, are continuing to explore online opportunities. McKevitt added: “Amazon announced this week that it will be adding its own branded groceries to its UK website, supplementing its existing tie-up with Morrisons. This could bring its offer more in line with what we know about British shopping habits. The British public is among the most reliant in the world on retailer own-label brands. Currently, 11% of Amazon’s grocery sales are own-label lines, well below the 50% market average.”

Like-for-like grocery prices have been falling since April this year and Kantar’s data shows this trend continued over the last 12-week period with a drop of 0.8%. However, the past four weeks saw a slightly different picture emerge with inflation growing by 0.4%. McKevitt explained: “Although relatively low, this four-week level of inflation would still add £19 to the average household’s annual grocery bill. It’s expected that inflation will rise again in the coming months, and as a result we’ll likely see shoppers seeking to tighten the purse strings and save where they can.”

Looking at the performance of individual retailers, Waitrose was the only grocer to increase sales in the past 12 weeks, with growth of 0.6% as it attracted 365,000 more shoppers than it did last year. The retailer expanded its market share by 0.2 percentage points, up to 4.9%.

Tesco’s share of grocery sales also increased by 0.6 percentage points from 26.6% to 27.2%, its largest year-on-year share gain since 2007. Sales were bolstered by its premium ‘Finest’ range, which rose by £29m

Sainsbury’s share nudged up by 0.3 percentage points to give it 15.2% of the market. Asda’s edged down to 14.2% despite a 17% jump in the number of shopping trips to its stores compared with last year. Meanwhile, Morrisons share dipped to 10.0% after its sales fell by 6.2% against its strong performance last year.

Meanwhile, Aldi and Lidl both gained market share again. Aldi now holds 8.2% of the market and Lidl 6.1%.

Co-op and Iceland, two of the standout performers of the past 18 months, saw their sales fall year-on-year and market shares slip to 6.6% and 2.3% respectively.

NAM Implications:

- A solid base of online Loyals has emerged…

- ‘Ocado has retained 1.8% of total grocery sales, the same as last year, and sales are up by 44.4% compared with 2019, the fastest two-year growth in the market.’

- Says it all for Ocado.

- Meanwhile, with 11% of Amazon grocery in own-label…

- …they have plenty of O/L headspace vs mkt average 50%.

- ‘Aldi now holds 8.2% of the market and Lidl 6.1%’ illustrates the continuing discounter threat…