Latest market share figures from Kantar show take-home grocery sales rose by 12.2% during the 12 weeks to 24 January. This was an acceleration on the Christmas period as the reintroduction of lockdown restrictions and the shutdown of the hospitality sector saw eating out of the home curtailed once more. In January alone, shoppers spent £1bn more on supermarket food and drink items compared to the same four-week period last year.

One year on since the first Covid-19 cases were detected in Britain, Kantar highlighted that clear patterns remain in shopping habits by different age demographics. In the latest four-week period, people under 28, who are typically more open to visiting physical shops, increased spending in larger physical stores by 12%. Over-45s, on the other hand, cut back spend in bigger supermarkets by 1%, and the rapid growth of online shopping, which hit a record share of 14.0% this month, is being led by the oldest demographics.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Retired households have boosted their online spend by a staggering 229% compared with January 2020. Older people are clearly getting more comfortable and proficient at ordering online and they now make up 28% of the 6.4 million who used online services in Great Britain this month.”

The return of home-schooling also boosted demand with the average family spending £50 more on groceries in January than they did last year as they stocked up on child-friendly lunch options. Meanwhile, the usual healthy new year’s resolutions contributed to sales of vegan-specific ranges growing by 23% year-on-year and sales of no-alcohol beer increasing by 12%. However, it appears many people turned to drink to keep their spirits up during a tough winter month with overall alcohol sales growing by £234m, an uplift of 29% on last year.

McKevitt said: “We expect to see strong growth for all the grocers fall off as we reach the anniversary of the first national lockdown in March. Sales will then be measured against the high volumes recorded in spring and summer 2020. With the vaccine rollout underway, there’s also hope that the hospitality sector will re-open, meaning demand for take-home groceries is likely to subside. Brexit has been another talking point, though steady grocery inflation of 1.3% this month suggests any pricing impact is yet to be felt by consumers.”

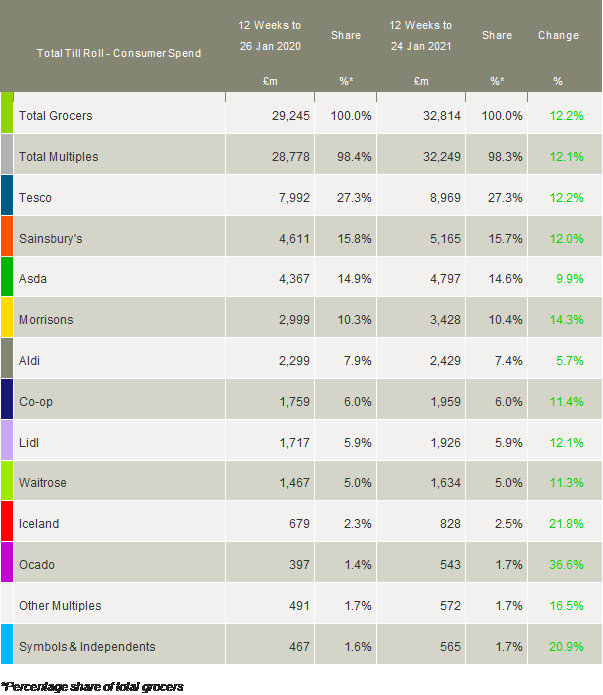

Looking at the performance of the key retailers in the sector, convenience stores, including independent corner shops and those operated by the major chains, recorded their highest four-week ending share of the market since September at 12.9%. Co-op saw its sales increase by 11.4% with its new Honest Value line of products adding more than £1m in sales. Meanwhile, independent and symbol retailers grew sales by 20.9% and accounted for 1.7% of the market this period.

Ocado was once again the fastest-growing grocery retailer – with its sales surging up 36.6%, and market share increasing by 0.3 percentage points to 1.7%. Waitrose’s premium online offer also helped it to grow by 11.3%, while its market share stayed level at 5.0%. Iceland continued its strong run, with sales up by 21.8%, meaning it has now grown every period since April 2018.

Of the Big Four supermarkets, Morrisons increased sales the fastest, with growth of 14.3%. It gained share for the eighth month in a row, now claiming 10.4% of all sales. Tesco had another strong month with sales rising by 12.2%, in step with the overall market, and it maintained a market share of 27.3%. Sainsbury’s also posted a solid increase of 12.0%, and Asda’s growth of 9.9% was its best performance since July, helping to narrow the gap with its rivals.

Sales at Lidl grew by 12.1%, with a market share of 5.9% – the same as last year. However, its fellow discounter Aldi continued its poor run with its market share slipping from 7.9% last year to 7.4% after sales increased by only 5.7%.

NamNews Points to ponder:

- How different would your account management structure look if manpower talent was allocated by the growth rate of the retailer?

- Why are new store openings not affecting discounter market share?

- How far off a full-scale price war between Aldi and Lidl are we?

- Who are going to be the losers later this year when retail sales start to fall as foodservice revives, schools reopen and some people go back to work?

- BTW, out of interest, how do your c-stores, Ocado And Morrisons sales compare?

- The issue has to be the extent to which these trends will be reversed, if at all, post Lockdown.