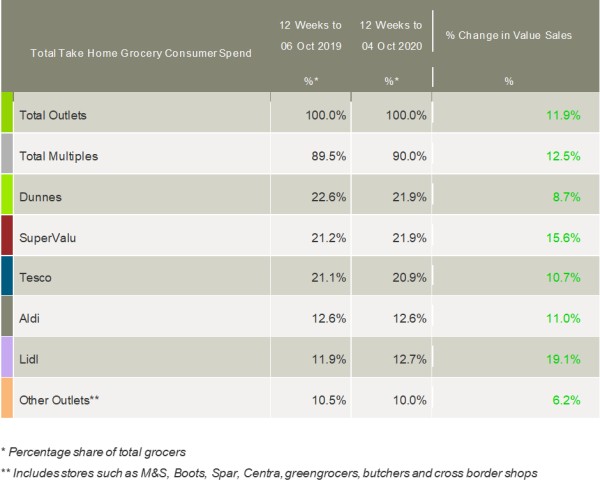

Latest figures from Kantar show take-home grocery sales growth in Ireland slowed to 11.9% year on year during the 12 weeks to 4 October 2020. However, stronger growth of 12.2% over the latest four weeks points to shoppers preparing to spend more time at home in the coming months as the government takes action to curb the rise of Covid-19 infections.

Emer Healy, retail analyst at Kantar, commented: “While growth over the past three months has slowed compared with the dizzying heights of lockdown, we still spent over €100m more on groceries in the past four weeks versus this time last year. We expect to see a further boost in spend as restrictions tighten.”

With Dublin under a Level Three lockdown since mid-September, Kantar suggested that consumer trends in the capital could paint a picture of what’s to come for the rest of the country as more measures to control the virus come into force.

Healy said: “Dublin saw the strongest regional growth this period, increasing sales by 19.4% and contributing an additional €48.2m to the total market year on year. Restrictions on pubs and restaurants meant sales of alcohol soared by over 53% in the past month. Shoppers returned to lockdown pastimes including recreating restaurant and holiday favourites at home, with sales of international ingredients rising by 25%. Unsurprisingly, hygiene was at the forefront of Dubliners’ minds, and antiseptics and disinfectants sales were up by 67%.”

Lidl’s strong store footprint in Dublin helped it achieve the fastest growth of all the retailers in Ireland this period at 19.1%, as shoppers in the capital spent an additional €57.3m in store. Aldi grew sales by 11.0%, largely driven by customers buying more and spending an average of €36.46 more per shopper in the latest 12 weeks.

Following record-breaking growth seen last period, online grocery sales remained high, increasing by over 75% in the four weeks to 4 October. Healy commented: “Though a climbdown from the record jump of 128% that we witnessed in September, shoppers are continuing to make use of delivery services and online orders were worth an additional €18.7m this period compared with last year.”

Dunnes has significantly expanded its online capabilities in October and now joins SuperValu at the top of the table with both retailers claiming a 21.9% market share. Larger trips contributed an additional €63m to Dunnes’ overall spend, while shoppers picking up 13.3% more items in store in SuperValu helped it to grow ahead of the market at 15.6%.

Tesco held a 20.9% market share this period after seeing growth of 10.7%. This was driven by shoppers adding extra items to their baskets, with volumes up 21%, and the percentage increase in average spend at Tesco was the highest among all the retailers.

Kantar’s data showed grocery market inflation stood at 1.8% over the 12-week period.

NAM Implications:

- Key is how your sales are comparing…

- …by retailer and category.