Data from Nielsen confirms that supermarkets in the UK are experiencing a slow start to the festive season, with grocery sales growing by just 0.2% in the last four weeks.

The weak growth is a significant drop in comparison to the same period last year when sales grew 2.3%. Nielsen suggested that this could in part be attributed to the busy Black Friday sales period with cautious shoppers switching their spend away from the weekly grocery shop to take advantage of non-food offers available on the high street and online. The analytics company’s data shows that supermarkets experienced a decline of 0.7% in sales during the Black Friday week.

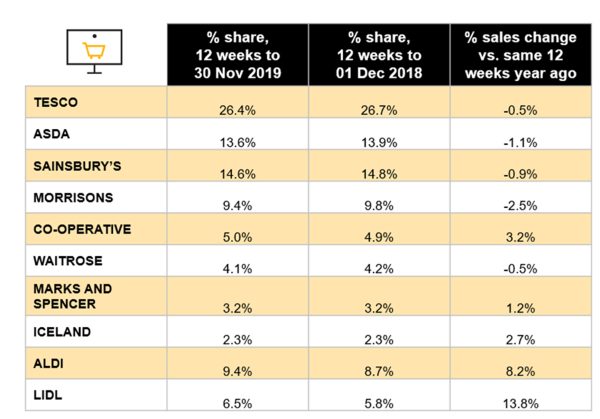

The big four supermarkets all experienced a decline in sales in the last 12 weeks. However, Lidl showed significant growth (+13.8%), followed by steady growth at Aldi (+8.2%), the Co-op (+3.2%), Iceland (+2.7%) and Marks & Spencer (+1.2%).

The data also showed the best performing FMCG categories were pet food/pet care (+1.6%) and crisps and snacks (+1.3%), whilst the weakest were meat, fish and poultry (-2.2%) and household items (-2.1 %).

Despite the slow start to the festive season, Nielsen is forecasting that shoppers will spend around £7.2bn at the major supermarkets in the two weeks to 28 December, a slight increase over last year. This will account for just under 21% of all food retail sales during the ‘Golden Quarter’.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, pointed to research that shows around one third of shoppers never intended to start their Christmas grocery shopping until December: “This means that there is still a strong chance that grocery sales will pick up pace, but this depends on how the crucial final two weeks of the year perform. A late surge in sales is quite possible this year as Christmas Eve falls on a Tuesday.”

He added: “UK supermarkets must also take into account the increasing role of multichannel and omnichannel retail with modern consumers. Though 44% of UK shoppers still intend to do the big Christmas shop in a physical store, only 7% expect to do the full shop online and the remainder will shop across both. Retailers must therefore ensure that offers stretch across both platforms in order to effectively reach consumers.

“Cautious spenders will also be looking for alternative means of funding the big Christmas shop, with 35% intending to use their saved loyalty points. This signals the importance of loyalty schemes and vouchers, as consumers seek to reap the rewards at this time of year.”